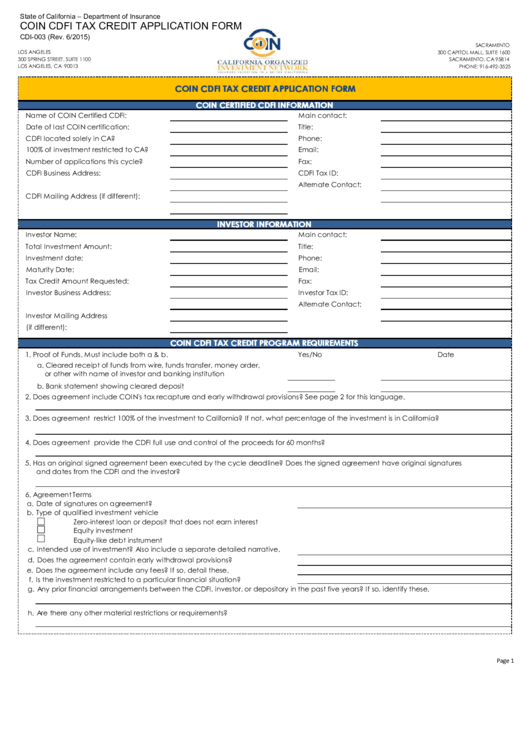

State of California – Department of Insurance

COIN CDFI TAX CREDIT APPLICATION FORM

CDI-003 (Rev. 6/2015)

SACRAMENTO

LOS ANGELES

300 CAPITOL MALL, SUITE 1600

300 SPRING STREET, SUITE 1100

SACRAMENTO, CA 95814

LOS ANGELES, CA 90013

PHONE: 916-492-3525

COIN CDFI TAX CREDIT APPLICATION FORM

COIN CERTIFIED CDFI INFORMATION

Name of COIN Certified CDFI:

Main contact:

Date of last COIN certification:

Title:

CDFI located solely in CA?

Phone:

100% of investment restricted to CA?

Email:

Number of applications this cycle?

Fax:

CDFI Business Address:

CDFI Tax ID:

Alternate Contact:

CDFI Mailing Address (if different):

INVESTOR INFORMATION

Investor Name:

Main contact:

Total Investment Amount:

Title:

Investment date:

Phone:

Maturity Date:

Email:

Tax Credit Amount Requested:

Fax:

Investor Business Address:

Investor Tax ID:

Alternate Contact:

Investor Mailing Address

(if different):

COIN CDFI TAX CREDIT PROGRAM REQUIREMENTS

1. Proof of Funds. Must include both a & b.

Yes/No

Date

a. Cleared receipt of funds from wire, funds transfer, money order,

or other with name of investor and banking institution

b. Bank statement showing cleared deposit

2. Does agreement include COIN's tax recapture and early withdrawal provisions? See page 2 for this language.

3. Does agreement restrict 100% of the investment to California? If not, what percentage of the investment is in California?

4. Does agreement provide the CDFI full use and control of the proceeds for 60 months?

5. Has an original signed agreement been executed by the cycle deadline? Does the signed agreement have original signatures

and dates from the CDFI and the investor?

6. Agreement Terms

a. Date of signatures on agreement?

b. Type of qualified investment vehicle

Zero-interest loan or deposit that does not earn interest

Equity investment

Equity-like debt instrument

c. Intended use of investment? Also include a separate detailed narrative.

d. Does the agreement contain early withdrawal provisions?

e. Does the agreement include any fees? If so, detail these.

f. Is the investment restricted to a particular financial situation?

g. Any prior financial arrangements between the CDFI, investor, or depository in the past five years? If so, identify these.

h. Are there any other material restrictions or requirements?

Page 1

1

1 2

2