1

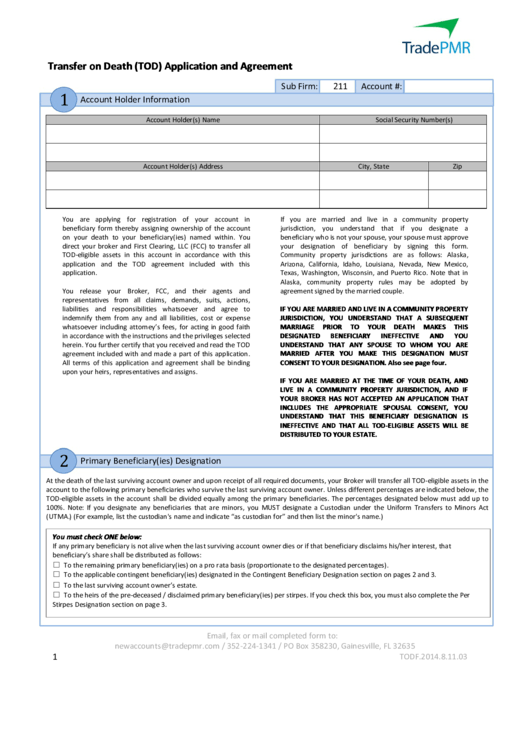

Transfer on Death (TOD) Application and Agreement

Sub Firm:

211

Account #:

Account Holder Information

Account Holder(s) Name

Social Security Number(s)

Account Holder(s) Address

City, State

Zip

You are applying for registration of your account in

If you are married and live in a community property

beneficiary form thereby assigning ownership of the account

jurisdiction, you understand that if you designate a

on your death to your beneficiary(ies) named within. You

beneficiary who is not your spouse, your spouse must approve

direct your broker and First Clearing, LLC (FCC) to transfer all

your designation of beneficiary by signing this form.

TOD-eligible assets in this account in accordance with this

Community property jurisdictions are as follows: Alaska,

application and the TOD agreement included with this

Arizona, California, Idaho, Louisiana, Nevada, New Mexico,

application.

Texas, Washington, Wisconsin, and Puerto Rico. Note that in

Alaska, community property rules may be adopted by

You release your Broker, FCC, and their agents and

agreement signed by the married couple.

representatives from all claims, demands, suits, actions,

IF YOU ARE MARRIED AND LIVE IN A COMMUNITY PROPERTY

liabilities and responsibilities whatsoever and agree to

indemnify them from any and all liabilities, cost or expense

JURISDICTION, YOU UNDERSTAND THAT A SUBSEQUENT

whatsoever including attorney’s fees, for acting in good faith

MARRIAGE

PRIOR

TO

YOUR

DEATH

MAKES

THIS

in accordance with the instructions and the privileges selected

DESIGNATED

BENEFICIARY

INEFFECTIVE

AND

YOU

herein. You further certify that you received and read the TOD

UNDERSTAND THAT ANY SPOUSE TO WHOM YOU ARE

agreement included with and made a part of this application.

MARRIED AFTER YOU MAKE THIS DESIGNATION MUST

All terms of this application and agreement shall be binding

CONSENT TO YOUR DESIGNATION. Also see page four.

upon your heirs, representatives and assigns.

IF YOU ARE MARRIED AT THE TIME OF YOUR DEATH, AND

LIVE IN A COMMUNITY PROPERTY JURISDICTION, AND IF

YOUR BROKER HAS NOT ACCEPTED AN APPLICATION THAT

INCLUDES THE APPROPRIATE SPOUSAL CONSENT, YOU

UNDERSTAND THAT THIS BENEFICIARY DESIGNATION IS

2

INEFFECTIVE AND THAT ALL TOD-ELIGIBLE ASSETS WILL BE

DISTRIBUTED TO YOUR ESTATE.

Primary Beneficiary(ies) Designation

At the death of the last surviving account owner and upon receipt of all required documents, your Broker will transfer all TOD-eligible assets in the

account to the following primary beneficiaries who survive the last surviving account owner. Unless different percentages are indicated below, the

TOD-eligible assets in the account shall be divided equally among the primary beneficiaries. The percentages designated below must add up to

100%. Note: If you designate any beneficiaries that are minors, you MUST designate a Custodian under the Uniform Transfers to Minors Act

(UTMA.) (For example, list the custodian's name and indicate “as custodian for” and then list the minor's name.)

You must check ONE below:

If any primary beneficiary is not alive when the last surviving account owner dies or if that beneficiary disclaims his/her interest, that

beneficiary’s share shall be distributed as follows:

To the remaining primary beneficiary(ies) on a pro rata basis (proportionate to the designated percentages).

☐

To the applicable contingent beneficiary(ies) designated in the Contingent Beneficiary Designation section on pages 2 and 3.

☐

To the last surviving account owner’s estate.

☐

To the heirs of the pre-deceased / disclaimed primary beneficiary(ies) per stirpes. If you check this box, you must also complete the Per

☐

Stirpes Designation section on page 3.

Email, fax or mail completed form to:

/ 352-224-1341 / PO Box 358230, Gainesville, FL 32635

1

TODF.2014.8.11.03

1

1 2

2 3

3 4

4 5

5 6

6