Election Of Income Tax Withholdings

ADVERTISEMENT

I.U.O.E. Local 4 Benefit Funds Office

P.O. Box 680

Medway, MA 02053

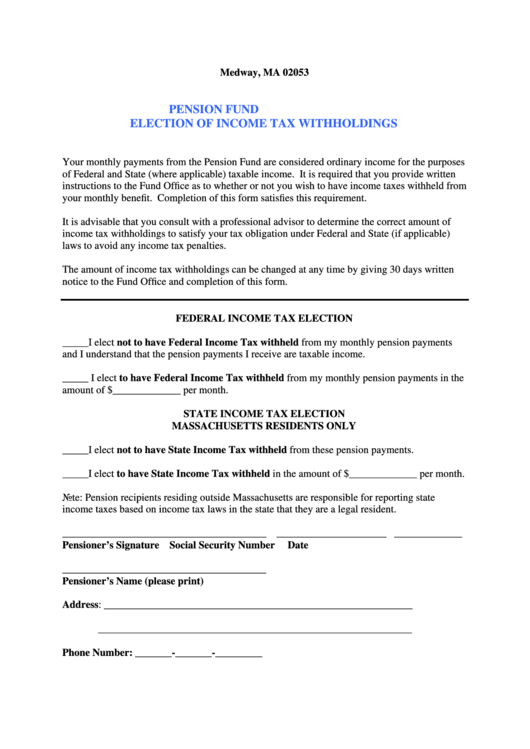

I.U.O.E. LOCAL 4 PENSION FUND

ELECTION OF INCOME TAX WITHHOLDINGS

Your monthly payments from the Pension Fund are considered ordinary income for the purposes

of Federal and State (where applicable) taxable income. It is required that you provide written

instructions to the Fund Office as to whether or not you wish to have income taxes withheld from

your monthly benefit. Completion of this form satisfies this requirement.

It is advisable that you consult with a professional advisor to determine the correct amount of

income tax withholdings to satisfy your tax obligation under Federal and State (if applicable)

laws to avoid any income tax penalties.

The amount of income tax withholdings can be changed at any time by giving 30 days written

notice to the Fund Office and completion of this form.

FEDERAL INCOME TAX ELECTION

_____I elect not to have Federal Income Tax withheld from my monthly pension payments

and I understand that the pension payments I receive are taxable income.

_____ I elect to have Federal Income Tax withheld from my monthly pension payments in the

amount of $_____________ per month.

STATE INCOME TAX ELECTION

MASSACHUSETTS RESIDENTS ONLY

_____I elect not to have State Income Tax withheld from these pension payments.

_____I elect to have State Income Tax withheld in the amount of $_____________ per month.

Note: Pension recipients residing outside Massachusetts are responsible for reporting state

income taxes based on income tax laws in the state that they are a legal resident.

_______________________________________ _____________________ _____________

Pensioner’s Signature

Social Security Number

Date

_______________________________________

Pensioner’s Name (please print)

Address: ___________________________________________________________

____________________________________________________________

Phone Number: _______-_______-_________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1