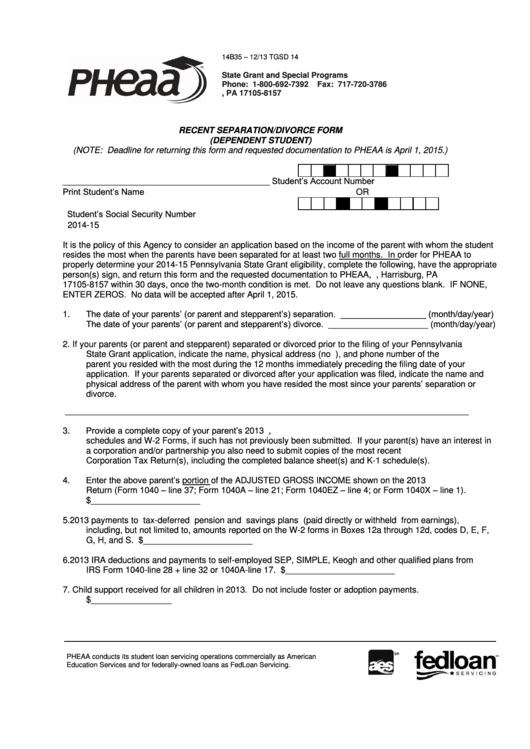

Recent Separation/divorce Form (Dependent Student)

ADVERTISEMENT

14B35 – 12/13

TGSD 14

State Grant and Special Programs

Phone: 1-800-692-7392

Fax: 717-720-3786

P.O. Box 8157 Harrisburg, PA 17105-8157

RECENT SEPARATION/DIVORCE FORM

(DEPENDENT STUDENT)

(NOTE: Deadline for returning this form and requested documentation to PHEAA is April 1, 2015.)

Student’s Account Number

_______________________________________________

Print Student’s Name

OR

Student’s Social Security Number

2014-15

It is the policy of this Agency to consider an application based on the income of the parent with whom the student

resides the most when the parents have been separated for at least two full months. In order for PHEAA to

properly determine your 2014-15 Pennsylvania State Grant eligibility, complete the following, have the appropriate

person(s) sign, and return this form and the requested documentation to PHEAA, P.O. Box 8157, Harrisburg, PA

17105-8157 within 30 days, once the two-month condition is met. Do not leave any questions blank. IF NONE,

ENTER ZEROS. No data will be accepted after April 1, 2015.

The date of your parents’ (or parent and stepparent’s) separation. __________________ (month/day/year)

1.

The date of your parents’ (or parent and stepparent’s) divorce. _____________________ (month/day/year)

2.

If your parents (or parent and stepparent) separated or divorced prior to the filing of your Pennsylvania

State Grant application, indicate the name, physical address (no P.O. Boxes), and phone number of the

parent you resided with the most during the 12 months immediately preceding the filing date of your

application. If your parents separated or divorced after your application was filed, indicate the name and

physical address of the parent with whom you have resided the most since your parents’ separation or

divorce.

_____________________________________________________________________________________

Provide a complete copy of your parent’s 2013 U.S. Income Tax Return including all supporting forms,

3.

schedules and W-2 Forms, if such has not previously been submitted. If your parent(s) have an interest in

a corporation and/or partnership you also need to submit copies of the most recent U.S. Partnership and/or

Corporation Tax Return(s), including the completed balance sheet(s) and K-1 schedule(s).

Enter the above parent’s portion of the ADJUSTED GROSS INCOME shown on the 2013 U.S. Income Tax

4.

Return (Form 1040 – line 37; Form 1040A – line 21; Form 1040EZ – line 4; or Form 1040X – line 1).

$_______________________

5.

2013 payments to tax-deferred pension and savings plans (paid directly or withheld from earnings),

including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E, F,

G, H, and S. $_______________________

6.

2013 IRA deductions and payments to self-employed SEP, SIMPLE, Keogh and other qualified plans from

IRS Form 1040-line 28 + line 32 or 1040A-line 17. $_______________________

7.

Child support received for all children in 2013.

Do not include foster or adoption payments.

$_________________

PHEAA conducts its student loan servicing operations commercially as American

Education Services and for federally-owned loans as FedLoan Servicing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3