Self Employed Business Revenues And Expense List

ADVERTISEMENT

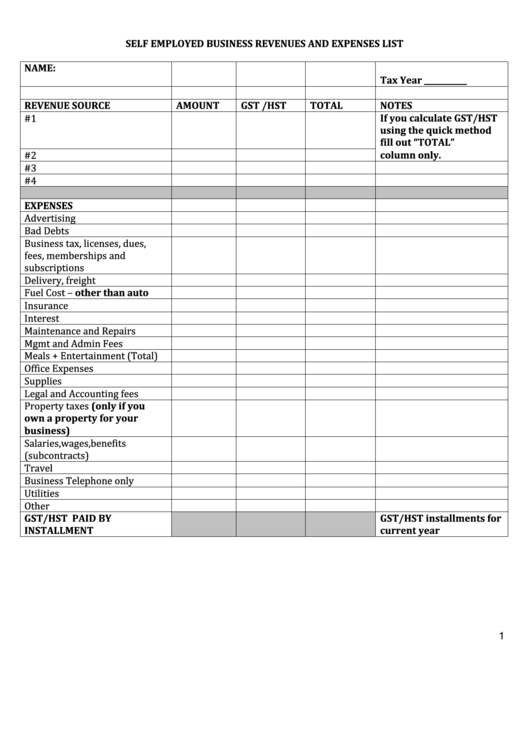

SELF EMPLOYED BUSINESS REVENUES AND EXPENSES LIST

NAME:

Tax Year ___________

REVENUE SOURCE

AMOUNT

GST /HST

TOTAL

NOTES

#1

If you calculate GST/HST

using the quick method

fill out “TOTAL”

#2

column only.

#3

#4

EXPENSES

Advertising

Bad Debts

Business tax, licenses, dues,

fees, memberships and

subscriptions

Delivery, freight

Fuel Cost – other than auto

Insurance

Interest

Maintenance and Repairs

Mgmt and Admin Fees

Meals + Entertainment (Total)

Office Expenses

Supplies

Legal and Accounting fees

Property taxes (only if you

own a property for your

business)

Salaries,wages,benefits

(subcontracts)

Travel

Business Telephone only

Utilities

Other

GST/HST PAID BY

GST/HST installments for

INSTALLMENT

current year

1

ADVERTISEMENT

1 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2