Employee Representation Regarding Use Of Company Vehicle Form

ADVERTISEMENT

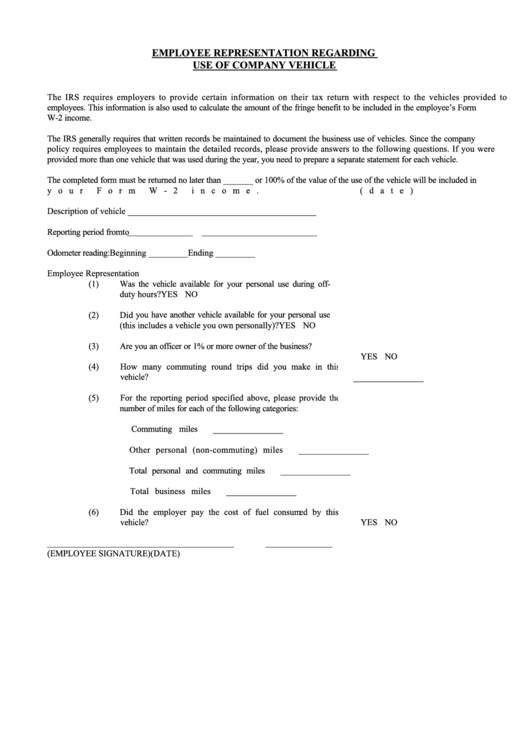

EMPLOYEE REPRESENTATION REGARDING

USE OF COMPANY VEHICLE

The IRS requires employers to provide certain information on their tax return with respect to the vehicles provided to

employees. This information is also used to calculate the amount of the fringe benefit to be included in the employee’s Form

W-2 income.

The IRS generally requires that written records be maintained to document the business use of vehicles. Since the company

policy requires employees to maintain the detailed records, please provide answers to the following questions. If you were

provided more than one vehicle that was used during the year, you need to prepare a separate statement for each vehicle.

The completed form must be returned no later than _______ or 100% of the value of the use of the vehicle will be included in

your Form W-2 income.

(date)

Description of vehicle ___________________________________________

Reporting period from

to

Odometer reading:

Beginning _________

Ending _________

Employee Representation

(1)

Was the vehicle available for your personal use during off-

duty hours?

YES NO

(2)

Did you have another vehicle available for your personal use

(this includes a vehicle you own personally)?

YES NO

(3)

Are you an officer or 1% or more owner of the business?

YES NO

(4)

How many commuting round trips did you make in this

vehicle?

________________

(5)

For the reporting period specified above, please provide the

number of miles for each of the following categories:

Commuting miles

________________

Other personal (non-commuting) miles

________________

Total personal and commuting miles

________________

Total business miles

________________

(6)

Did the employer pay the cost of fuel consumed by this

vehicle?

YES NO

(EMPLOYEE SIGNATURE)

(DATE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4