Form D-400x - Amended Individual Income Tax Return - 2014

ADVERTISEMENT

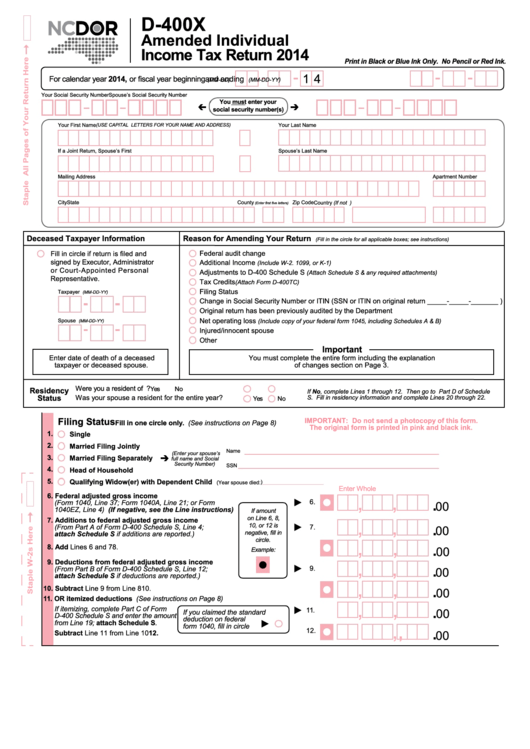

D-400X

Amended Individual

Income Tax Return 2014

Print in Black or Blue Ink Only. No Pencil or Red Ink.

1 4

For calendar year 2014, or fiscal year beginning

and ending

(MM-DD)

(MM-DD-YY)

Your Social Security Number

Spouse’s Social Security Number

You must enter your

social security number(s)

Your First Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

M.I.

Your Last Name

If a Joint Return, Spouse’s First Name

M.I.

Spouse’s Last Name

Mailing Address

Apartment Number

City

State

Zip Code

Country (If not U.S.)

County

(Enter first five letters)

Deceased Taxpayer Information

Reason for Amending Your Return

(Fill in the circle for all applicable boxes; see instructions)

Federal audit change

Fill in circle if return is filed and

signed by Executor, Administrator

Additional Income

(Include W-2. 1099, or K-1)

or Court-Appointed Personal

Adjustments to D-400 Schedule S

(Attach Schedule S & any required attachments)

Representative.

Tax Credits

(Attach Form D-400TC)

Filing Status

Taxpayer

(MM-DD-YY)

Change in Social Security Number or ITIN (SSN or ITIN on original return _____-_____-_______ )

Original return has been previously audited by the Department

Net operating loss

Spouse

(Include copy of your federal form 1045, including Schedules A & B)

(MM-DD-YY)

Injured/innocent spouse

Other

Important

Enter date of death of a deceased

You must complete the entire form including the explanation

taxpayer or deceased spouse.

of changes section on Page 3.

Were you a resident of N.C. for the entire year of 2014?

Yes

No

Residency

If No, complete Lines 1 through 12. Then go to Part D of Schedule

Status

Was your spouse a resident for the entire year?

S. Fill in residency information and complete Lines 20 through 22.

Yes

No

Filing Status

IMPORTANT: Do not send a photocopy of this form.

Fill in one circle only. (See instructions on Page 8)

The original form is printed in pink and black ink.

1.

Single

2.

Married Filing Jointly

Name

(Enter your spouse’s

3.

Married Filing Separately

full name and Social

Security Number)

SSN

4.

Head of Household

5.

Qualifying Widow(er) with Dependent Child

)

(Year spouse died:

Enter Whole U.S. Dollars Only

,

,

.

6. Federal adjusted gross income

6.

(Form 1040, Line 37; Form 1040A, Line 21; or Form

00

1040EZ, Line 4) (If negative, see the Line instructions)

If amount

on Line 6, 8,

,

,

.

7. Additions to federal adjusted gross income

10, or 12 is

(From Part A of Form D-400 Schedule S, Line 4;

7.

00

negative, fill in

attach Schedule S if additions are reported.)

,

,

.

circle.

8. Add Lines 6 and 7

8.

00

Example:

,

,

.

9. Deductions from federal adjusted gross income

9.

(From Part B of Form D-400 Schedule S, Line 12;

00

attach Schedule S if deductions are reported.)

,

,

.

10. Subtract Line 9 from Line 8

10.

00

11. N.C. standard deduction OR itemized deductions (See instructions on Page 8)

,

,

.

If itemizing, complete Part C of Form

11.

00

If you claimed the standard

D-400 Schedule S and enter the amount

deduction on federal

,

,

from Line 19; attach Schedule S.

.

form 1040, fill in circle

12.

00

12.

Subtract Line 11 from Line 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3