Self Employed Form - Test Valley

ADVERTISEMENT

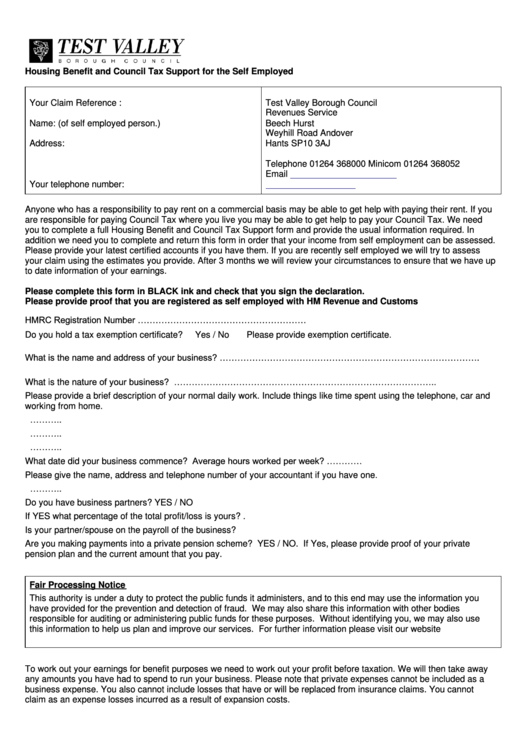

Housing Benefit and Council Tax Support for the Self Employed

Your Claim Reference :

Test Valley Borough Council

Revenues Service

Name: (of self employed person.)

Beech Hurst

Weyhill Road Andover

Address:

Hants SP10 3AJ

Telephone 01264 368000 Minicom 01264 368052

Email

benefits@testvalley.gov.uk

Your telephone number:

Anyone who has a responsibility to pay rent on a commercial basis may be able to get help with paying their rent. If you

are responsible for paying Council Tax where you live you may be able to get help to pay your Council Tax. We need

you to complete a full Housing Benefit and Council Tax Support form and provide the usual information required. In

addition we need you to complete and return this form in order that your income from self employment can be assessed.

Please provide your latest certified accounts if you have them. If you are recently self employed we will try to assess

your claim using the estimates you provide. After 3 months we will review your circumstances to ensure that we have up

to date information of your earnings.

Please complete this form in BLACK ink and check that you sign the declaration.

Please provide proof that you are registered as self employed with HM Revenue and Customs

HMRC Registration Number …………………………………………………

Do you hold a tax exemption certificate?

Yes / No

Please provide exemption certificate.

What is the name and address of your business? …………………………………………………………………………….

..................................................................................................................

What is the nature of your business? ……………………………………………………………………………..

Please provide a brief description of your normal daily work. Include things like time spent using the telephone, car and

working from home.

..................................................................................................... ……….. .........................................................

..................................................................................................... ……….. .........................................................

..................................................................................................... ……….. .........................................................

What date did your business commence? ................................... Average hours worked per week? …………

Please give the name, address and telephone number of your accountant if you have one.

..................................................................................................... ……….. .........................................................

Do you have business partners? YES / NO

If YES what percentage of the total profit/loss is yours? . ..................................................................................

Is your partner/spouse on the payroll of the business? .....................................................................................

Are you making payments into a private pension scheme? YES / NO. If Yes, please provide proof of your private

pension plan and the current amount that you pay.

Fair Processing Notice

This authority is under a duty to protect the public funds it administers, and to this end may use the information you

have provided for the prevention and detection of fraud. We may also share this information with other bodies

responsible for auditing or administering public funds for these purposes. Without identifying you, we may also use

this information to help us plan and improve our services.

For further information please visit our website

To work out your earnings for benefit purposes we need to work out your profit before taxation. We will then take away

any amounts you have had to spend to run your business. Please note that private expenses cannot be included as a

business expense. You also cannot include losses that have or will be replaced from insurance claims. You cannot

claim as an expense losses incurred as a result of expansion costs.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2