Economic Worksheet: Creating An Amortization Schedule

ADVERTISEMENT

Amortization Schedules

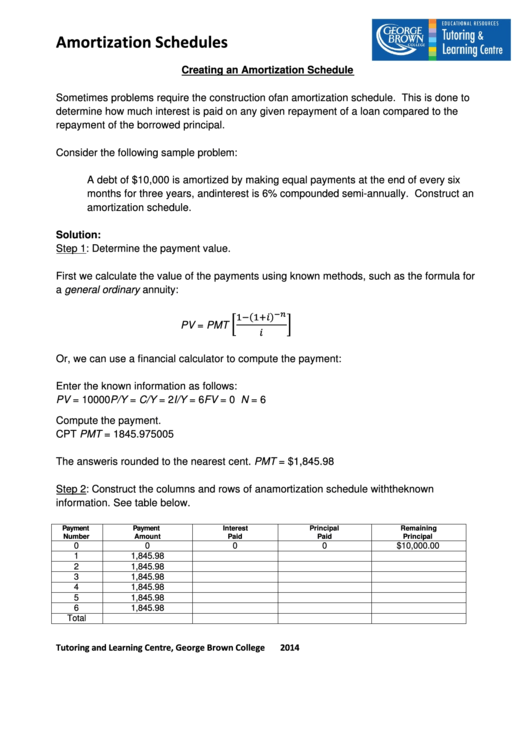

Creating an Amortization Schedule

Sometimes problems require the construction of an amortization schedule. This is done to

determine how much interest is paid on any given repayment of a loan compared to the

repayment of the borrowed principal.

Consider the following sample problem:

A debt of $10,000 is amortized by making equal payments at the end of every six

months for three years, and interest is 6% compounded semi-annually. Construct an

amortization schedule.

Solution:

Step 1: Determine the payment value.

First we calculate the value of the payments using known methods, such as the formula for

a general ordinary annuity:

�

�

1− ( 1+�� )

−��

��

PV = PMT

Or, we can use a financial calculator to compute the payment:

Enter the known information as follows:

PV = 10000

P/Y = C/Y = 2

I/Y = 6

FV = 0

N = 6

Compute the payment.

CPT PMT = 1845.975005

The answer is rounded to the nearest cent. PMT = $1,845.98

Step 2: Construct the columns and rows of an amortization schedule with the known

information. See table below.

Payment

Payment

Interest

Principal

Remaining

Number

Amount

Paid

Paid

Principal

0

0

0

0

$10,000.00

1

1,845.98

2

1,845.98

3

1,845.98

4

1,845.98

5

1,845.98

6

1,845.98

Total

Tutoring and Learning Centre, George Brown College

2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2