Claims Form - Fsa Dependent Care

ADVERTISEMENT

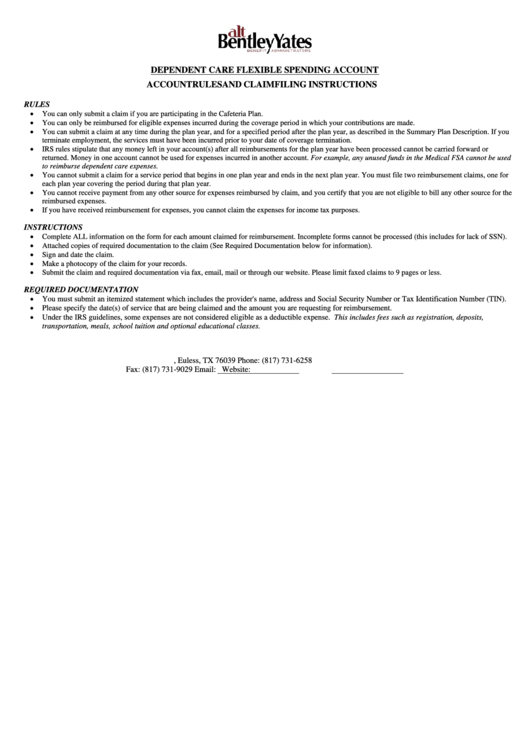

DEPENDENT CARE FLEXIBLE SPENDING ACCOUNT

ACCOUNT RULES AND CLAIM FILING INSTRUCTIONS

RULES

You can only submit a claim if you are participating in the Cafeteria Plan.

You can only be reimbursed for eligible expenses incurred during the coverage period in which your contributions are made.

You can submit a claim at any time during the plan year, and for a specified period after the plan year, as described in the Summary Plan Description. If you

terminate employment, the services must have been incurred prior to your date of coverage termination.

IRS rules stipulate that any money left in your account(s) after all reimbursements for the plan year have been processed cannot be carried forward or

returned. Money in one account cannot be used for expenses incurred in another account. For example, any unused funds in the Medical FSA cannot be used

to reimburse dependent care expenses.

You cannot submit a claim for a service period that begins in one plan year and ends in the next plan year. You must file two reimbursement claims, one for

each plan year covering the period during that plan year.

You cannot receive payment from any other source for expenses reimbursed by claim, and you certify that you are not eligible to bill any other source for the

reimbursed expenses.

If you have received reimbursement for expenses, you cannot claim the expenses for income tax purposes.

INSTRUCTIONS

Complete ALL information on the form for each amount claimed for reimbursement. Incomplete forms cannot be processed (this includes for lack of SSN).

Attached copies of required documentation to the claim (See Required Documentation below for information).

Sign and date the claim.

Make a photocopy of the claim for your records.

Submit the claim and required documentation via fax, email, mail or through our website. Please limit faxed claims to 9 pages or less.

REQUIRED DOCUMENTATION

You must submit an itemized statement which includes the provider's name, address and Social Security Number or Tax Identification Number (TIN).

Please specify the date(s) of service that are being claimed and the amount you are requesting for reimbursement.

Under the IRS guidelines, some expenses are not considered eligible as a deductible expense. This includes fees such as registration, deposits,

transportation, meals, school tuition and optional educational classes.

P.O. Box 520, Euless, TX 76039 Phone: (817) 731-6258

Fax: (817) 731-9029 Email: Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2