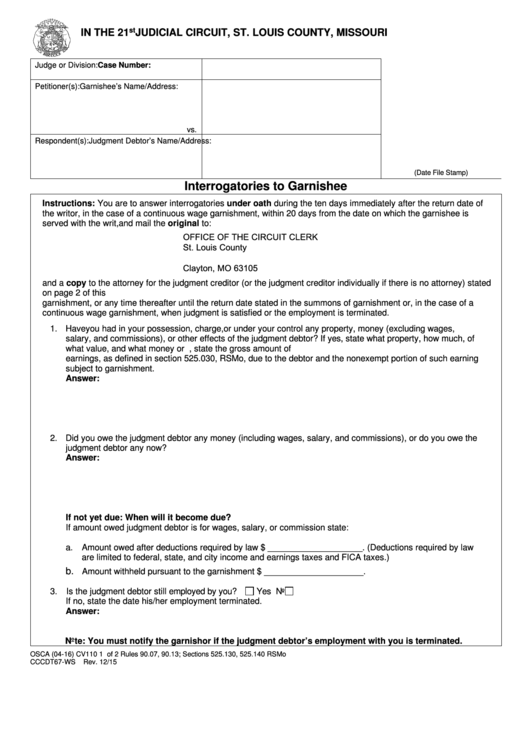

st

IN THE 21

JUDICIAL CIRCUIT, ST. LOUIS COUNTY, MISSOURI

Judge or Division:

Case Number:

Petitioner(s):

Garnishee’s Name/Address:

vs.

Respondent(s):

Judgment Debtor’s Name/Address:

(Date File Stamp)

Interrogatories to Garnishee

Instructions: You are to answer interrogatories under oath during the ten days immediately after the return date of

the writ or, in the case of a continuous wage garnishment, within 20 days from the date on which the garnishee is

served with the writ, and mail the original to:

OFFICE OF THE CIRCUIT CLERK

St. Louis County

P.O. Box 16994

Clayton, MO 63105

and a copy to the attorney for the judgment creditor (or the judgment creditor individually if there is no attorney) stated

on page 2 of this form. The answers to the interrogatories should be based from the time of service of the

garnishment, or any time thereafter until the return date stated in the summons of garnishment or, in the case of a

continuous wage garnishment, when judgment is satisfied or the employment is terminated.

1. Have you had in your possession, charge, or under your control any property, money (excluding wages,

salary, and commissions), or other effects of the judgment debtor? If yes, state what property, how much, of

what value, and what money or effects. In the case of a wage garnishment, state the gross amount of

earnings, as defined in section 525.030, RSMo, due to the debtor and the nonexempt portion of such earning

subject to garnishment.

Answer:

2. Did you owe the judgment debtor any money (including wages, salary, and commissions), or do you owe the

judgment debtor any now?

Answer:

If not yet due: When will it become due?

If amount owed judgment debtor is for wages, salary, or commission state:

a. Amount owed after deductions required by law $ ____________________. (Deductions required by law

are limited to federal, state, and city income and earnings taxes and FICA taxes.)

b.

Amount withheld pursuant to the garnishment $ _____________________.

3. Is the judgment debtor still employed by you?

Yes

No

If no, state the date his/her employment terminated.

Answer:

Note: You must notify the garnishor if the judgment debtor’s employment with you is terminated.

OSCA (04-16) CV110

1 of 2

Rules 90.07, 90.13; Sections 525.130, 525.140 RSMo

CCCDT67-WS

Rev. 12/15

1

1 2

2