HOW TO REQUEST REIMBURSEMENT FROM YOUR DEPENDENT CARE ACCOUNT

Use this form to request reimbursement for your dependent care expenses only. To view a detailed list of eligible dependent care expenses, visit

FSAFEDS Eligible Expenses Juke Box

at In general, the following rules apply to dependent care expenses:

Dependent care expenses qualify if they are for the care of children under age 13 or other dependents that are physically or mentally incapable of caring for himself or

herself. These expenses must be incurred so that you and your spouse, if married, can work, or your spouse can attend school full-time. However, if either you or your

spouse had no earned income for the year, you are not eligible for the Dependent Care FSA. For more information, refer to the dependent care section of the

Summary of Benefits and Frequently Asked Questions.

The annual amount of reimbursed dependent care claims cannot exceed:

Your annual deposit amount up to $5,000 ($2,500 if you and your spouse are filing separate returns), or

•

Your annual salary or your spouse’s annual salary, if less than $5,000, or

•

Your annual election plus any childcare subsidies cannot total more than $6,000, depending on your tax situation.

•

• Children must be under age 13 or physically or mentally incapable of caring for themselves if over age 13.

• Services provided by a childcare or elder care center must comply with all state and local laws to be an eligible reimbursement expense.

• FSAFEDS cannot pay for services that have not been rendered.

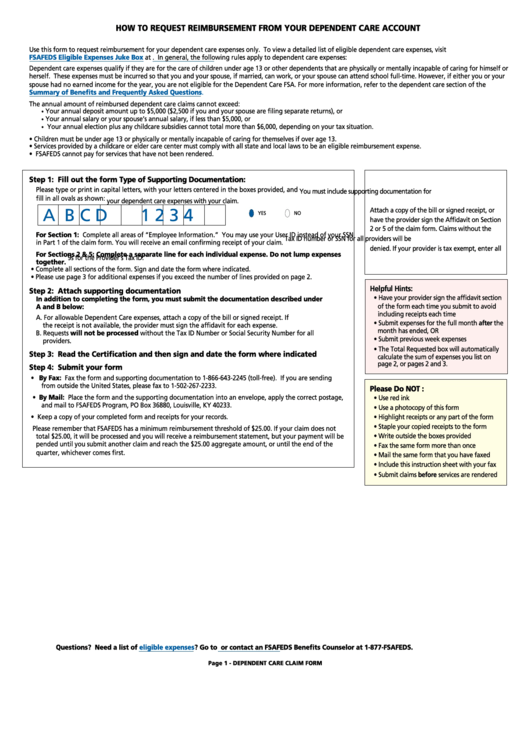

Step 1: Fill out the form

Type of Supporting Documentation:

Please type or print in capital letters, with your letters centered in the boxes provided, and

You must include supporting documentation for

fill in all ovals as shown:

your dependent care expenses with your claim.

A B C D

1 2 3 4

Attach a copy of the bill or signed receipt, or

YES

NO

have the provider sign the Affidavit on Section

2 or 5 of the claim form. Claims without the

For Section 1: Complete all areas of “Employee Information.” You may use your User ID instead of your SSN

Tax ID number or SSN for all providers will be

in Part 1 of the claim form. You will receive an email confirming receipt of your claim.

denied. If your provider is tax exempt, enter all

For Sections 2 & 5: Complete a separate line for each individual expense. Do not lump expenses

9s for the Provider’s Tax ID.

together.

• Complete all sections of the form. Sign and date the form where indicated.

• Please use page 3 for additional expenses if you exceed the number of lines provided on page 2.

Helpful Hints:

Step 2: Attach supporting documentation

• Have your provider sign the affidavit section

In addition to completing the form, you must submit the documentation described under

A and B below:

of the form each time you submit to avoid

including receipts each time

A. For allowable Dependent Care expenses, attach a copy of the bill or signed receipt. If

• Submit expenses for the full month after the

the receipt is not available, the provider must sign the affidavit for each expense.

month has ended, OR

B. Requests will not be processed without the Tax ID Number or Social Security Number for all

• Submit previous week expenses

providers.

• The Total Requested box will automatically

Step 3: Read the Certification and then sign and date the form where indicated

calculate the sum of expenses you list on

page 2, or pages 2 and 3.

Step 4: Submit your form

• By Fax: Fax the form and supporting documentation to 1-866-643-2245 (toll-free). If you are sending

from outside the United States, please fax to 1-502-267-2233.

Please Do NOT :

• By Mail: Place the form and the supporting documentation into an envelope, apply the correct postage,

• Use red ink

and mail to FSAFEDS Program, PO Box 36880, Louisville, KY 40233.

• Use a photocopy of this form

• Keep a copy of your completed form and receipts for your records.

• Highlight receipts or any part of the form

• Staple your copied receipts to the form

Please remember that FSAFEDS has a minimum reimbursement threshold of $25.00. If your claim does not

total $25.00, it will be processed and you will receive a reimbursement statement, but your payment will be

• Write outside the boxes provided

pended until you submit another claim and reach the $25.00 aggregate amount, or until the end of the

• Fax the same form more than once

quarter, whichever comes first.

• Mail the same form that you have faxed

• Include this instruction sheet with your fax

• Submit claims before services are rendered

Questions? Need a list of

eligible

expenses? Go to

or contact an FSAFEDS Benefits Counselor at 1-877-FSAFEDS.

Page 1 - DEPENDENT CARE CLAIM FORM

1

1 2

2 3

3