Surplus Line Producers Quarterly Tax Statement Form

ADVERTISEMENT

Tax Statement

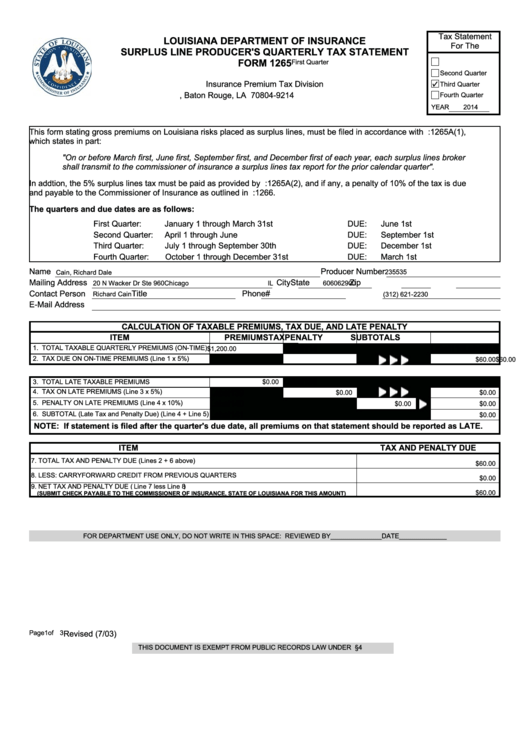

LOUISIANA DEPARTMENT OF INSURANCE

For The

SURPLUS LINE PRODUCER'S QUARTERLY TAX STATEMENT

FORM 1265

First Quarter

Second Quarter

Insurance Premium Tax Division

Third Quarter

P.O. Box 94214, Baton Rouge, LA 70804-9214

Fourth Quarter

YEAR

2014

This form stating gross premiums on Louisiana risks placed as surplus lines, must be filed in accordance with L.R.S. 22:1265A(1),

which states in part:

"On or before March first, June first, September first, and December first of each year, each surplus lines broker

shall transmit to the commissioner of insurance a surplus lines tax report for the prior calendar quarter".

In addtion, the 5% surplus lines tax must be paid as provided by L.R.S. 22:1265A(2), and if any, a penalty of 10% of the tax is due

and payable to the Commissioner of Insurance as outlined in L.R.S. 22:1266.

The quarters and due dates are as follows:

First Quarter:

January 1 through March 31st

DUE:

June 1st

Second Quarter:

April 1 through June

DUE:

September 1st

Third Quarter:

July 1 through September 30th

DUE:

December 1st

Fourth Quarter:

October 1 through December 31st

DUE:

March 1st

Name

Producer Number

Cain, Richard Dale

235535

Mailing Address

City

State

Zip

20 N Wacker Dr Ste 960

Chicago

IL

606062900

Contact Person

Title

Phone#

Richard Cain

(312) 621-2230

E-Mail Address

CALCULATION OF TAXABLE PREMIUMS, TAX DUE, AND LATE PENALTY

ITEM

PREMIUMS

TAX

PENALTY

SUBTOTALS

1. TOTAL TAXABLE QUARTERLY PREMIUMS (ON-TIME)

Label114

Label116

Label115

$1,200.00

2. TAX DUE ON ON-TIME PREMIUMS (Line 1 x 5%)

$60.00

$60.00

Label138

3. TOTAL LATE TAXABLE PREMIUMS

$0.00

4. TAX ON LATE PREMIUMS (Line 3 x 5%)

Label139

$0.00

$0.00

5. PENALTY ON LATE PREMIUMS (Line 4 x 10%)

Label140

$0.00

$0.00

6. SUBTOTAL (Late Tax and Penalty Due) (Line 4 + Line 5)

Label141

$0.00

NOTE: If statement is filed after the quarter's due date, all premiums on that statement should be reported as LATE.

ITEM

TAX AND PENALTY DUE

7. TOTAL TAX AND PENALTY DUE (Lines 2 + 6 above)

$60.00

8. LESS: CARRYFORWARD CREDIT FROM PREVIOUS QUARTERS

$0.00

9. NET TAX AND PENALTY DUE (Line 7 less Line 8)

$60.00

(SUBMIT CHECK PAYABLE TO THE COMMISSIONER OF INSURANCE, STATE OF LOUISIANA FOR THIS AMOUNT)

FOR DEPARTMENT USE ONLY, DO NOT WRITE IN THIS SPACE: REVIEWED BY______________DATE_____________

Page 1

of 3

Revised (7/03)

THIS DOCUMENT IS EXEMPT FROM PUBLIC RECORDS LAW UNDER L.R.S. 44§4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3