Form Dr 501sc - Sworn Statement Of Adjusted Gross Income Of Household And Return - 2008

ADVERTISEMENT

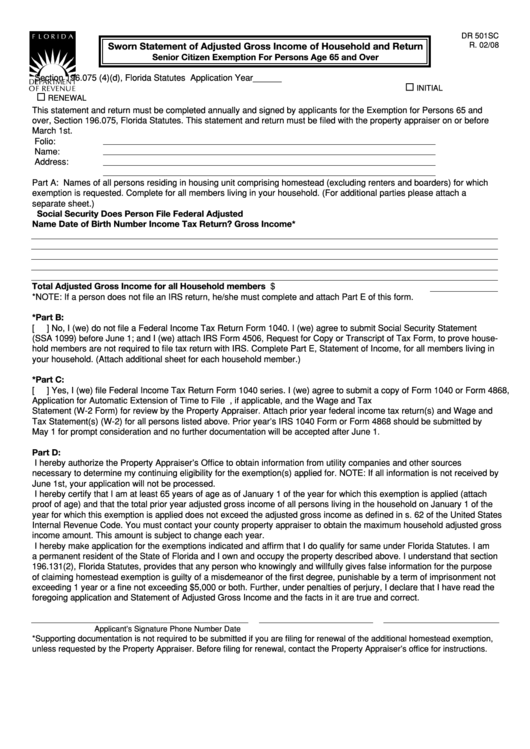

DR 501SC

Sworn Statement of Adjusted Gross Income of Household and Return

R. 02/08

Senior Citizen Exemption For Persons Age 65 and Over

Section 196.075 (4)(d), Florida Statutes

Application Year______

®

INITIAl

®

RENEWAl

This statement and return must be completed annually and signed by applicants for the Exemption for Persons 65 and

over, Section 196.075, Florida Statutes. This statement and return must be filed with the property appraiser on or before

March 1st.

Folio:

Name:

Address:

Part A: Names of all persons residing in housing unit comprising homestead (excluding renters and boarders) for which

exemption is requested. Complete for all members living in your household. (For additional parties please attach a

separate sheet.)

Social Security Does Person File Federal

Adjusted

Name

Date of Birth

Number

Income Tax Return?

Gross Income*

Total Adjusted Gross Income for all Household members

$

*NOTE: If a person does not file an IRS return, he/she must complete and attach Part E of this form.

*Part B:

[

] No, I (we) do not file a Federal Income Tax Return Form 1040. I (we) agree to submit Social Security Statement

(SSA 1099) before June 1; and I (we) attach IRS Form 4506, Request for Copy or Transcript of Tax Form, to prove house-

hold members are not required to file tax return with IRS. Complete Part E, Statement of Income, for all members living in

your household. (Attach additional sheet for each household member.)

*Part C:

[

] Yes, I (we) file Federal Income Tax Return Form 1040 series. I (we) agree to submit a copy of Form 1040 or Form 4868,

Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, if applicable, and the Wage and Tax

Statement (W-2 Form) for review by the Property Appraiser. Attach prior year federal income tax return(s) and Wage and

Tax Statement(s) (W-2) for all persons listed above. Prior year’s IRS 1040 Form or Form 4868 should be submitted by

May 1 for prompt consideration and no further documentation will be accepted after June 1.

Part D:

I hereby authorize the Property Appraiser’s Office to obtain information from utility companies and other sources

necessary to determine my continuing eligibility for the exemption(s) applied for. NOTE: If all information is not received by

June 1st, your application will not be processed.

I hereby certify that I am at least 65 years of age as of January 1 of the year for which this exemption is applied (attach

proof of age) and that the total prior year adjusted gross income of all persons living in the household on January 1 of the

year for which this exemption is applied does not exceed the adjusted gross income as defined in s. 62 of the United States

Internal Revenue Code. You must contact your county property appraiser to obtain the maximum household adjusted gross

income amount. This amount is subject to change each year.

I hereby make application for the exemptions indicated and affirm that I do qualify for same under Florida Statutes. I am

a permanent resident of the State of Florida and I own and occupy the property described above. I understand that section

196.131(2), Florida Statutes, provides that any person who knowingly and willfully gives false information for the purpose

of claiming homestead exemption is guilty of a misdemeanor of the first degree, punishable by a term of imprisonment not

exceeding 1 year or a fine not exceeding $5,000 or both. Further, under penalties of perjury, I declare that I have read the

foregoing application and Statement of Adjusted Gross Income and the facts in it are true and correct.

Applicant’s Signature

Phone Number

Date

*Supporting documentation is not required to be submitted if you are filing for renewal of the additional homestead exemption,

unless requested by the Property Appraiser. Before filing for renewal, contact the Property Appraiser’s office for instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2