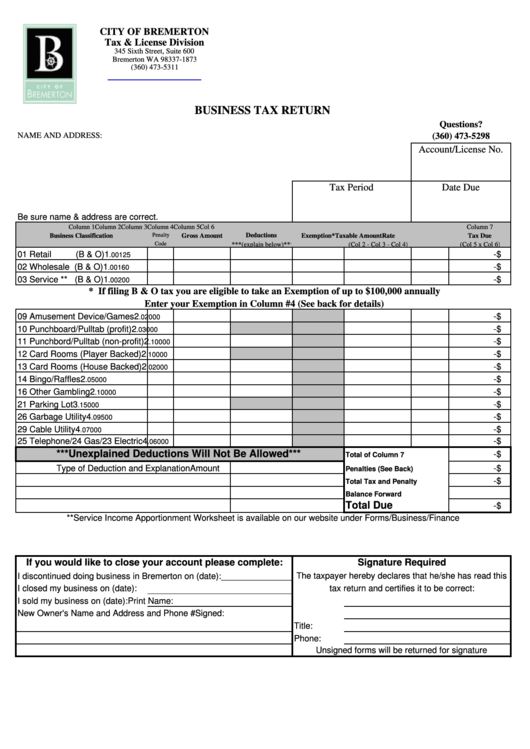

Business Tax Return Form

ADVERTISEMENT

CITY OF BREMERTON

Tax & License Division

345 Sixth Street, Suite 600

Bremerton WA 98337-1873

(360) 473-5311

BUSINESS TAX RETURN

Questions?

NAME AND ADDRESS:

(360) 473-5298

Account/License No.

Tax Period

Date Due

Be sure name & address are correct.

Column 1

Column 2

Column 3

Column 4

Column 5

Col 6

Column 7

Penalty

Deductions

Business Classification

Gross Amount

Exemption*

Taxable Amount

Rate

Tax Due

Code

***(explain below)***

(Col 2 - Col 3 - Col 4)

(Col 5 x Col 6)

01 Retail

(B & O)

1

$

-

.00125

02 Wholesale (B & O)

1

$

-

.00160

03 Service ** (B & O)

1

$

-

.00200

* If filing B & O tax you are eligible to take an Exemption of up to $100,000 annually

Enter your Exemption in Column #4 (See back for details)

09 Amusement Device/Games

2

$

-

.02000

10 Punchboard/Pulltab (profit)

2

$

-

.03000

11 Punchbord/Pulltab (non-profit)

2

$

-

.10000

12 Card Rooms (Player Backed)

2

$

-

.10000

13 Card Rooms (House Backed)

2

$

-

.02000

14 Bingo/Raffles

2

$

-

.05000

16 Other Gambling

2

$

-

.10000

21 Parking Lot

3

$

-

.15000

26 Garbage Utility

4

$

-

.09500

29 Cable Utility

4

$

-

.07000

25 Telephone/24 Gas/23 Electric

4

$

-

.06000

***Unexplained Deductions Will Not Be Allowed***

$

-

Total of Column 7

Type of Deduction and Explanation

Amount

$

-

Penalties (See Back)

$

-

Total Tax and Penalty

Balance Forward

Total Due

$

-

**Service Income Apportionment Worksheet is available on our website under Forms/Business/Finance

If you would like to close your account please complete:

Signature Required

I discontinued doing business in Bremerton on (date):_______________

The taxpayer hereby declares that he/she has read this

I closed my business on (date):

tax return and certifies it to be correct:

I sold my business on (date):

Print Name:

New Owner's Name and Address and Phone #

Signed:

Title:

Phone:

Unsigned forms will be returned for signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1