Clear form

For office use only

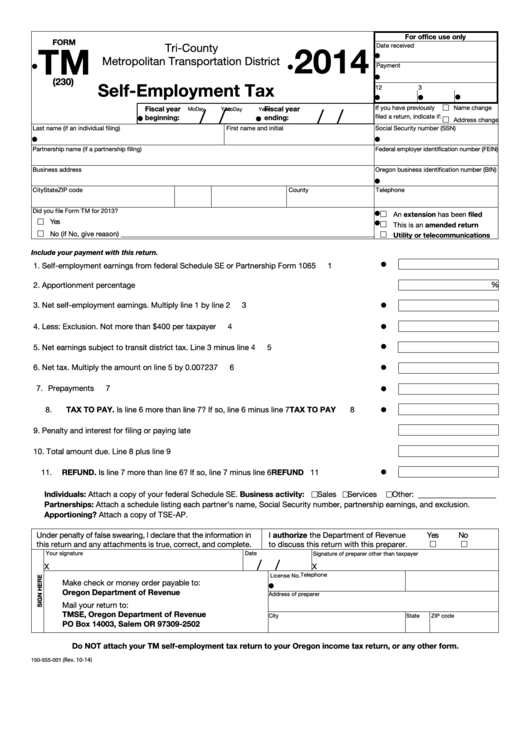

FORM

2014

TM

Tri-County

Date received

•

Metropolitan Transportation District

•

•

Payment

•

(230)

Self-Employment Tax

1

2

3

•

•

•

If you have previously

Name change

Fiscal year

Fiscal year

/ /

/ /

Mo

Day

Year

Mo

Day

Year

•

•

filed a return, indicate if:

beginning:

ending:

Address change

Last name (if an individual filing)

First name and initial

Social Security number (SSN)

•

•

Partnership name (if a partnership filing)

Federal employer identification number (FEIN)

Business address

Oregon business identification number (BIN)

•

City

State

ZIP code

County

Telephone

•

Did you file Form TM for 2013?

An extension has been filed

•

Yes

This is an amended return

•

No (if No, give reason) ________________________________________________________________________

Utility or telecommunications

Include your payment with this return.

•

1. Self-employment earnings from federal Schedule SE or Partnership Form 1065 .....................

1

%

2. Apportionment percentage ..............................................................................................................2

•

3. Net self-employment earnings. Multiply line 1 by line 2 .............................................................

3

•

4. Less: Exclusion. Not more than $400 per taxpayer ...................................................................

4

•

5. Net earnings subject to transit district tax. Line 3 minus line 4 .................................................

5

•

6. Net tax. Multiply the amount on line 5 by 0.007237 ...................................................................

6

•

7. Prepayments ..............................................................................................................................

7

•

8. TAX TO PAY. Is line 6 more than line 7? If so, line 6 minus line 7 ........................TAX TO PAY

8

9. Penalty and interest for filing or paying late .....................................................................................9

10. Total amount due. Line 8 plus line 9 ...............................................................................................10

•

11. REFUND. Is line 7 more than line 6? If so, line 7 minus line 6 .................................. REFUND

11

Individuals: Attach a copy of your federal Schedule SE. Business activity:

Sales

Services

Other: ____________________

Partnerships: Attach a schedule listing each partner’s name, Social Security number, partnership earnings, and exclusion.

Apportioning? Attach a copy of TSE-AP.

I authorize the Department of Revenue

Under penalty of false swearing, I declare that the information in

Yes

No

this return and any attachments is true, correct, and complete.

to discuss this return with this preparer.

Your signature

Date

Signature of preparer other than taxpayer

/ /

X

X

Telephone

License No.

Make check or money order payable to:

•

Oregon Department of Revenue

Address of preparer

Mail your return to:

TMSE, Oregon Department of Revenue

City

State

ZIP code

PO Box 14003, Salem OR 97309-2502

Do NOT attach your TM self-employment tax return to your Oregon income tax return, or any other form.

Rev. 10-14)

150-555-001 (

1

1