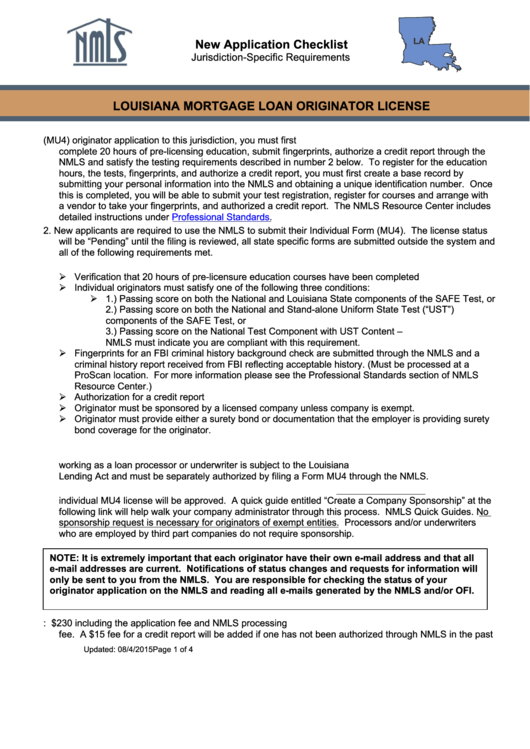

Louisiana Mortgage Loan Originator License

ADVERTISEMENT

LA

New Application Checklist

Jurisdiction-Specific Requirements

LOUISIANA MORTGAGE LOAN ORIGINATOR LICENSE

1. Before submitting an Individual Form (MU4) originator application to this jurisdiction, you must first

complete 20 hours of pre-licensing education, submit fingerprints, authorize a credit report through the

NMLS and satisfy the testing requirements described in number 2 below. To register for the education

hours, the tests, fingerprints, and authorize a credit report, you must first create a base record by

submitting your personal information into the NMLS and obtaining a unique identification number. Once

this is completed, you will be able to submit your test registration, register for courses and arrange with

a vendor to take your fingerprints, and authorized a credit report. The NMLS Resource Center includes

detailed instructions under

Professional

Standards.

2.

New applicants are required to use the NMLS to submit their Individual Form (MU4). The license status

will be “Pending” until the filing is reviewed, all state specific forms are submitted outside the system and

all of the following requirements met.

Verification that 20 hours of pre-licensure education courses have been completed

Individual originators must satisfy one of the following three conditions:

1.) Passing score on both the National and Louisiana State components of the SAFE Test, or

2.) Passing score on both the National and Stand-alone Uniform State Test (“UST”)

components of the SAFE Test, or

3.) Passing score on the National Test Component with UST Content –

NMLS must indicate you are compliant with this requirement.

Fingerprints for an FBI criminal history background check are submitted through the NMLS and a

criminal history report received from FBI reflecting acceptable history. (Must be processed at a

ProScan location. For more information please see the Professional Standards section of NMLS

Resource Center.)

Authorization for a credit report

Originator must be sponsored by a licensed company unless company is exempt.

Originator must provide either a surety bond or documentation that the employer is providing surety

bond coverage for the originator.

3. Each individual who originates mortgage loans and any individual who is an independent contractor

working as a loan processor or underwriter is subject to the Louisiana S.A.F.E. Residential Mortgage

Lending Act and must be separately authorized by filing a Form MU4 through the NMLS.

4. The company must submit a sponsorship request to the regulator for the originator only before the

individual MU4 license will be approved. A quick guide entitled “Create a Company Sponsorship” at the

following link will help walk your company administrator through this process. NMLS Quick Guides. No

sponsorship request is necessary for originators of exempt entities. Processors and/or underwriters

who are employed by third part companies do not require sponsorship.

NOTE: It is extremely important that each originator have their own e-mail address and that all

e-mail addresses are current. Notifications of status changes and requests for information will

only be sent to you from the NMLS. You are responsible for checking the status of your

originator application on the NMLS and reading all e-mails generated by the NMLS and/or OFI.

5. The fee for a new loan originator license is: $230 including the application fee and NMLS processing

fee. A $15 fee for a credit report will be added if one has not been authorized through NMLS in the past

Updated: 08/4/2015

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4