2013 Income Tax Information Organizer Template

ADVERTISEMENT

W

A

& T

S

, I

.

AGNER

CCOUNTING

AX

ERVICE

NC

999 Century Drive, Suite 5

607 Myatt Drive, Suite 1

Dubuque, Iowa 52002

Maquoketa, Iowa 52060

(563) 556-4508 Fax (563) 556-0407

(563) 652-5152 Fax (563) 652-5152

We wish you a Happy New Year and hope your 2014 is off to a great start! As

we start our 41st Tax Season, we thank you for allowing us the opportunity to serve

you. We encourage you to begin gathering your tax materials as soon as possible.

Your completion of this 2013 Tax Organizer will enable us to accurately prepare your

tax return with all income and allowable deductions. Certain rental, business, or farm

income should be detailed separately on other worksheets. If these worksheets are not

included, please let us know. Additionally, all of our organizer worksheets are avail-

able under the Forms tab of our website at IRS regulations re-

quire us to ask for your signature when you provide us with your tax return data.

We do not anticipate significant tax legislation in 2014, pending congressional

election. We continue to evaluate and implement changes from the American Tax-

payer Relief Act and the Affordable Care Act. Provisions effective for 2013 returns in-

clude: an additional 3.8% Net Investment Income Tax and an 0.9% additional Medi-

care Tax for certain taxpayers; some taxpayers will also see their itemized deductions

and personal exemptions limited; the 10% tax bracket is permanent, and a new highest

tax bracket of 39.6% has been created; the Alternative Minimum Tax has finally been

indexed to inflation; the deductions for Sales Tax, Educator Expenses, Private Mort-

gage Insurance (PMI), and Bonus Depreciation currently expire after 2013; the $1000

Child Tax Credit has been made permanent; and the American Opportunity Credit has

been extended for education expenses through 2017. All taxpayers are required to

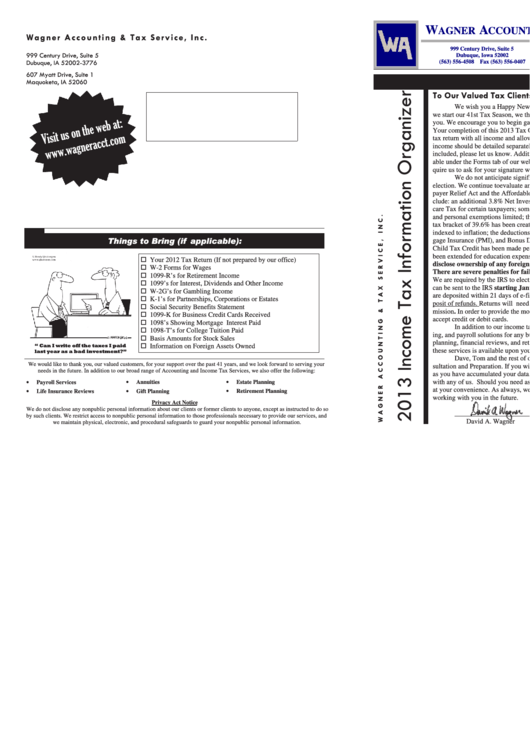

Your 2012 Tax Return (If not prepared by our office)

disclose ownership of any foreign assets, including bank or investment accounts.

W-2 Forms for Wages

There are severe penalties for failure to report these type of accounts.

1099-R’s for Retirement Income

We are required by the IRS to electronically file every eligible return. Returns

1099’s for Interest, Dividends and Other Income

can be sent to the IRS starting January 31st for most taxpayers. While most refunds

W-2G’s for Gambling Income

are deposited within 21 days of e-filing, the IRS will not guarantee dates for direct de-

K-1’s for Partnerships, Corporations or Estates

posit of refunds. Returns will need to be reviewed, signed and paid for prior to trans-

Social Security Benefits Statement

mission. In order to provide the most affordable service to all of our clients, we do not

1099-K for Business Credit Cards Received

accept credit or debit cards.

1098’s Showing Mortgage Interest Paid

In addition to our income tax services, we provide custom accounting, consult-

1098-T’s for College Tuition Paid

ing, and payroll solutions for any business. We also offer IRA and annuity sales, estate

Basis Amounts for Stock Sales

planning, financial reviews, and retirement planning. More information concerning

Information on Foreign Assets Owned

these services is available upon your request.

Dave, Tom and the rest of our tax staff will be available for Income Tax Con-

We would like to thank you, our valued customers, for your support over the past 41 years, and we look forward to serving your

sultation and Preparation. If you wish to schedule an appointment, please call as soon

needs in the future. In addition to our broad range of Accounting and Income Tax Services, we also offer the following:

as you have accumulated your data. Our office staff will be happy to schedule time

with any of us. Should you need assistance, or have a tax question, please contact us

Payroll Services

Annuities

Estate Planning

•

•

•

at your convenience. As always, we appreciate your past business and look forward to

Life Insurance Reviews

Gift Planning

Retirement Planning

•

•

•

working with you in the future.

Privacy Act Notice

We do not disclose any nonpublic personal information about our clients or former clients to anyone, except as instructed to do so

_________________________

_________________________

by such clients. We restrict access to nonpublic personal information to those professionals necessary to provide our services, and

David A. Wagner

Thomas A. Wagner

we maintain physical, electronic, and procedural safeguards to guard your nonpublic personal information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2