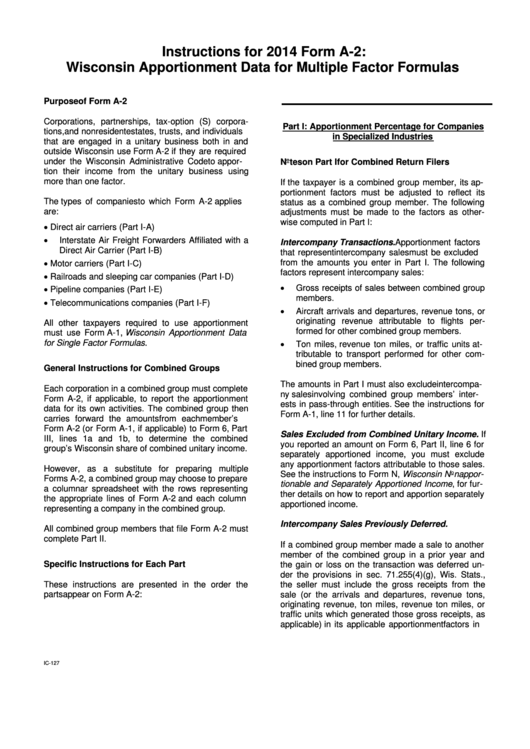

Instructions For 2014 Form A-2: Wisconsin Apportionment Data For Multiple Factor Formulas

ADVERTISEMENT

Instructions for 2014 Form A-2:

Wisconsin Apportionment Data for Multiple Factor Formulas

Purpose of Form A-2

Corporations, partnerships, tax-option (S) corpora-

Part I: Apportionment Percentage for Companies

tions, and nonresident estates, trusts, and individuals

in Specialized Industries

that are engaged in a unitary business both in and

outside Wisconsin use Form A-2 if they are required

under the Wisconsin Administrative Code to appor-

Notes on Part I for Combined Return Filers

tion their income from the unitary business using

more than one factor.

If the taxpayer is a combined group member, its ap-

portionment factors must be adjusted to reflect its

The types of companies to which Form A-2 applies

status as a combined group member. The following

are:

adjustments must be made to the factors as other-

wise computed in Part I:

•

Direct air carriers (Part I-A)

•

Interstate Air Freight Forwarders Affiliated with a

Intercompany Transactions. Apportionment factors

Direct Air Carrier (Part I-B)

that represent intercompany sales must be excluded

•

from the amounts you enter in Part I. The following

Motor carriers (Part I-C)

factors represent intercompany sales:

•

Railroads and sleeping car companies (Part I-D)

•

•

Gross receipts of sales between combined group

Pipeline companies (Part I-E)

members.

•

Telecommunications companies (Part I-F)

•

Aircraft arrivals and departures, revenue tons, or

originating revenue attributable to flights per-

All other taxpayers required to use apportionment

formed for other combined group members.

must use Form A-1, Wisconsin Apportionment Data

•

for Single Factor Formulas.

Ton miles, revenue ton miles, or traffic units at-

tributable to transport performed for other com-

bined group members.

General Instructions for Combined Groups

The amounts in Part I must also exclude intercompa-

Each corporation in a combined group must complete

ny sales involving combined group members’ inter-

Form A-2, if applicable, to report the apportionment

ests in pass-through entities. See the instructions for

data for its own activities. The combined group then

Form A-1, line 11 for further details.

carries forward the amounts from each member’s

Form A-2 (or Form A-1, if applicable) to Form 6, Part

Sales Excluded from Combined Unitary Income. If

III, lines 1a and 1b, to determine the combined

you reported an amount on Form 6, Part II, line 6 for

group’s Wisconsin share of combined unitary income.

separately apportioned income, you must exclude

any apportionment factors attributable to those sales.

However, as a substitute for preparing multiple

See the instructions to Form N, Wisconsin Nonappor-

Forms A-2, a combined group may choose to prepare

tionable and Separately Apportioned Income, for fur-

a columnar spreadsheet with the rows representing

ther details on how to report and apportion separately

the appropriate lines of Form A-2 and each column

apportioned income.

representing a company in the combined group.

Intercompany Sales Previously Deferred.

All combined group members that file Form A-2 must

complete Part II.

If a combined group member made a sale to another

member of the combined group in a prior year and

Specific Instructions for Each Part

the gain or loss on the transaction was deferred un-

der the provisions in sec. 71.255(4)(g), Wis. Stats.,

These instructions are presented in the order the

the seller must include the gross receipts from the

parts appear on Form A-2:

sale (or the arrivals and departures, revenue tons,

originating revenue, ton miles, revenue ton miles, or

traffic units which generated those gross receipts, as

applicable) in its applicable apportionment factors in

IC-127

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3