Sample Promissory Note - Ohio Public Works Commission

ADVERTISEMENT

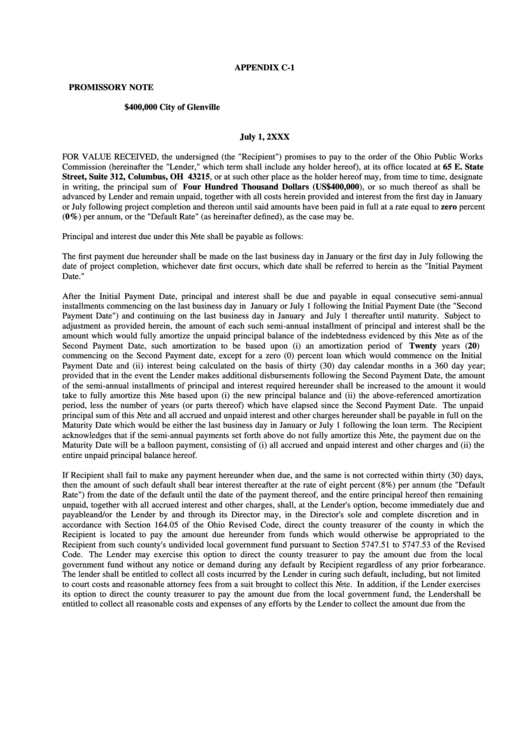

APPENDIX C-1

PROMISSORY NOTE

$400,000

City of Glenville

July 1, 2XXX

FOR VALUE RECEIVED, the undersigned (the "Recipient") promises to pay to the order of the Ohio Public Works

Commission (hereinafter the "Lender," which term shall include any holder hereof), at its office located at 65 E. State

Street, Suite 312, Columbus, OH 43215, or at such other place as the holder hereof may, from time to time, designate

in writing, the principal sum of Four Hundred Thousand Dollars (US$400,000), or so much thereof as shall be

advanced by Lender and remain unpaid, together with all costs herein provided and interest from the first day in January

or July following project completion and thereon until said amounts have been paid in full at a rate equal to zero percent

(0%) per annum, or the "Default Rate" (as hereinafter defined), as the case may be.

Principal and interest due under this Note shall be payable as follows:

The first payment due hereunder shall be made on the last business day in January or the first day in July following the

date of project completion, whichever date first occurs, which date shall be referred to herein as the "Initial Payment

Date."

After the Initial Payment Date, principal and interest shall be due and payable in equal consecutive semi-annual

installments commencing on the last business day in January or July 1 following the Initial Payment Date (the "Second

Payment Date") and continuing on the last business day in January and July 1 thereafter until maturity. Subject to

adjustment as provided herein, the amount of each such semi-annual installment of principal and interest shall be the

amount which would fully amortize the unpaid principal balance of the indebtedness evidenced by this Note as of the

Second Payment Date, such amortization to be based upon (i) an amortization period of

Twenty years (20)

commencing on the Second Payment date, except for a zero (0) percent loan which would commence on the Initial

Payment Date and (ii) interest being calculated on the basis of thirty (30) day calendar months in a 360 day year;

provided that in the event the Lender makes additional disbursements following the Second Payment Date, the amount

of the semi-annual installments of principal and interest required hereunder shall be increased to the amount it would

take to fully amortize this Note based upon (i) the new principal balance and (ii) the above-referenced amortization

period, less the number of years (or parts thereof) which have elapsed since the Second Payment Date. The unpaid

principal sum of this Note and all accrued and unpaid interest and other charges hereunder shall be payable in full on the

Maturity Date which would be either the last business day in January or July 1 following the loan term. The Recipient

acknowledges that if the semi-annual payments set forth above do not fully amortize this Note, the payment due on the

Maturity Date will be a balloon payment, consisting of (i) all accrued and unpaid interest and other charges and (ii) the

entire unpaid principal balance hereof.

If Recipient shall fail to make any payment hereunder when due, and the same is not corrected within thirty (30) days,

then the amount of such default shall bear interest thereafter at the rate of eight percent (8%) per annum (the "Default

Rate") from the date of the default until the date of the payment thereof, and the entire principal hereof then remaining

unpaid, together with all accrued interest and other charges, shall, at the Lender's option, become immediately due and

payable and/or the Lender by and through its Director may, in the Director's sole and complete discretion and in

accordance with Section 164.05 of the Ohio Revised Code, direct the county treasurer of the county in which the

Recipient is located to pay the amount due hereunder from funds which would otherwise be appropriated to the

Recipient from such county's undivided local government fund pursuant to Section 5747.51 to 5747.53 of the Revised

Code. The Lender may exercise this option to direct the county treasurer to pay the amount due from the local

government fund without any notice or demand during any default by Recipient regardless of any prior forbearance.

The lender shall be entitled to collect all costs incurred by the Lender in curing such default, including, but not limited

to court costs and reasonable attorney fees from a suit brought to collect this Note. In addition, if the Lender exercises

its option to direct the county treasurer to pay the amount due from the local government fund, the Lender shall be

entitled to collect all reasonable costs and expenses of any efforts by the Lender to collect the amount due from the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1 2

2