Tax Information Sheet

Download a blank fillable Tax Information Sheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Tax Information Sheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

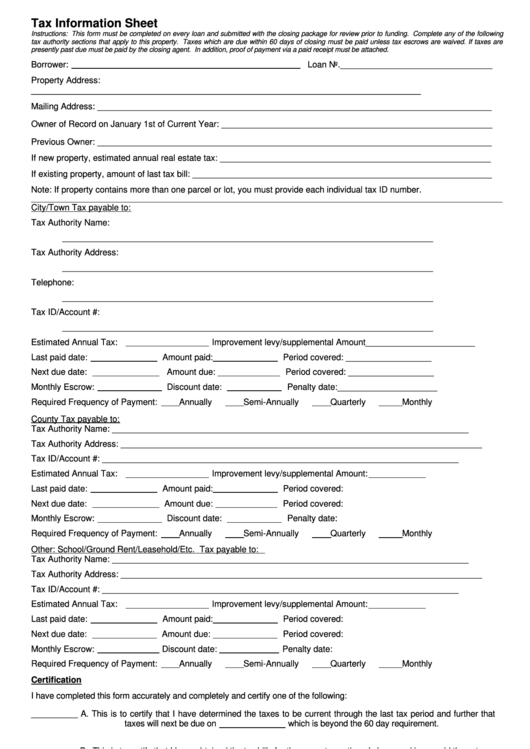

Tax Information Sheet

Instructions: This form must be completed on every loan and submitted with the closing package for review prior to funding. Complete any of the following

tax authority sections that apply to this property. Taxes which are due within 60 days of closing must be paid unless tax escrows are waived. If taxes are

presently past due must be paid by the closing agent. In addition, proof of payment via a paid receipt must be attached.

Borrower:

Loan No.________________________________

Property Address:

__________________________________________________________________________________

Mailing Address: ___________________________________________________________________________________

Owner of Record on January 1st of Current Year: _________________________________________________________

Previous Owner: ___________________________________________________________________________________

If new property, estimated annual real estate tax: _________________________________________________________

If existing property, amount of last tax bill: _______________________________________________________________

Note: If property contains more than one parcel or lot, you must provide each individual tax ID number.

_________________________________________________________________________________________________________________________

City/Town Tax payable to:

Tax Authority Name:

______________________________________________________________________________

Tax Authority Address:

______________________________________________________________________________

Telephone:

______________________________________________________________________________

Tax ID/Account #:

______________________________________________________________________________

Estimated Annual Tax:

Improvement levy/supplemental Amount_______________________

Last paid date:

Amount paid:

Period covered: __________________

Next due date:

Amount due:

Period covered: __________________

Monthly Escrow:

Discount date:

Penalty date:_____________________

Required Frequency of Payment:

Annually

Semi-Annually

Quarterly

Monthly

County Tax payable to:

Tax Authority Name:

___________________________________________________________________________

Tax Authority Address: ____________________________________________________________________________

Tax ID/Account #:

___________________________________________________________________________

Estimated Annual Tax:

Improvement levy/supplemental Amount:

Last paid date:

Amount paid:

Period covered:

Next due date:

Amount due:

Period covered:

Monthly Escrow:

Discount date:

Penalty date:

Required Frequency of Payment:

Annually

Semi-Annually

Quarterly

Monthly

Other: School/Ground Rent/Leasehold/Etc.

Tax payable to:

Tax Authority Name:

___________________________________________________________________________

Tax Authority Address: ____________________________________________________________________________

Tax ID/Account #:

___________________________________________________________________________

Estimated Annual Tax:

Improvement levy/supplemental Amount:

Last paid date:

Amount paid:

Period covered:

Next due date:

Amount due:

Period covered:

Monthly Escrow:

Discount date:

Penalty date:

Required Frequency of Payment:

Annually

Semi-Annually

Quarterly

Monthly

Certification

I have completed this form accurately and completely and certify one of the following:

__________ A. This is to certify that I have determined the taxes to be current through the last tax period and further that

taxes will next be due on

which is beyond the 60 day requirement.

__________ B. This is to certify that I have obtained the tax bills for the property captioned above and have paid those taxes

in full in the amount of $

on

for the taxes due on

. A tax

receipt is attached. Taxes are now current and are next due on

__________ C. Taxes are due less than 60 days from closing but bills are unavailable. Payment in the amount of

$

was collected at closing; payment will be made by Closing Agent/Lender (select one).

**Internal Use Only: SunTrust to disburse taxes

Lender to disburse taxes ___

____________________________________________________

__________________________

Closing Agent Signature

Date

COR 0034 (08/29/2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1