Client Tax Information Sheet

ADVERTISEMENT

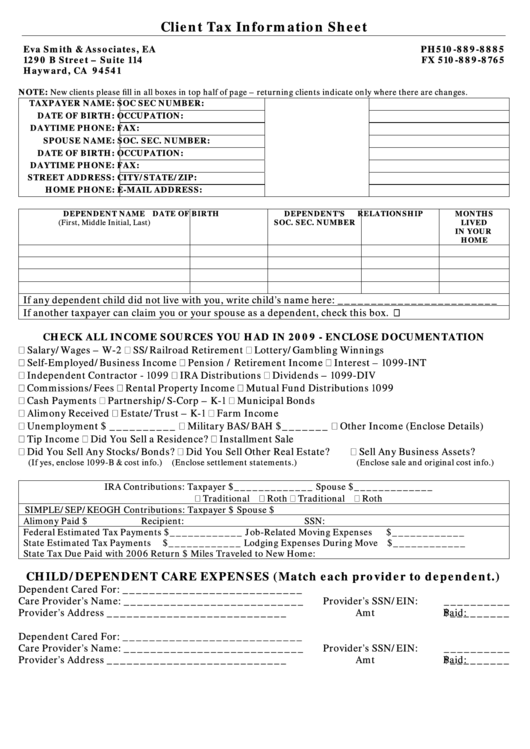

Client Tax Information Sheet

Eva Smith & Associates, EA

PH510-889-8885

1290 B Street – Suite 114

FX 510-889-8765

Hayward, CA 94541

T

NOTE: New clients please fill in all boxes in top half of page – returning clients indicate only where there are changes.

TAXPAYER NAME:

SOC SEC NUMBER:

DATE OF BIRTH:

OCCUPATION:

DAYTIME PHONE:

FAX:

SPOUSE NAME:

SOC. SEC. NUMBER:

DATE OF BIRTH:

OCCUPATION:

DAYTIME PHONE:

FAX:

STREET ADDRESS:

CITY/STATE/ZIP:

HOME PHONE:

E-MAIL ADDRESS:

DEPENDENT NAME

DATE OF BIRTH

DEPENDENT’S

RELATIONSHIP

MONTHS

(First, Middle Initial, Last)

SOC. SEC. NUMBER

LIVED

IN YOUR

HOME

If any dependent child did not live with you, write child’s name here: ________________________

If another taxpayer can claim you or your spouse as a dependent, check this box.

CHECK ALL INCOME SOURCES YOU HAD IN 2009 - ENCLOSE DOCUMENTATION

Salary/Wages – W-2

SS/Railroad Retirement

Lottery/Gambling Winnings

Self-Employed/Business Income

Pension / Retirement Income

Interest – 1099-INT

Independent Contractor - 1099

IRA Distributions

Dividends – 1099-DIV

Commissions/Fees

Rental Property Income

Mutual Fund Distributions 1099

Cash Payments

Partnership/S-Corp – K-1

Municipal Bonds

Alimony Received

Estate/Trust – K-1

Farm Income

Unemployment $ __________

Military BAS/BAH $_______

Other Income (Enclose Details)

Tip Income

Did You Sell a Residence?

Installment Sale

Did You Sell Any Stocks/Bonds?

Did You Sell Other Real Estate?

Sell Any Business Assets?

(If yes, enclose 1099-B & cost info.)

(Enclose settlement statements.)

(Enclose sale and original cost info.)

IRA Contributions: Taxpayer $_____________

Spouse $_____________

Traditional

Roth

Traditional

Roth

SIMPLE/SEP/KEOGH Contributions: Taxpayer $

Spouse $

Alimony Paid $

Recipient:

SSN:

Federal Estimated Tax Payments $____________

Job-Related Moving Expenses

$____________

State Estimated Tax Payments

$____________

Lodging Expenses During Move $____________

State Tax Due Paid with 2006 Return $

Miles Traveled to New Home:

CHILD/DEPENDENT CARE EXPENSES (Match each provider to dependent.)

Dependent Cared For:

___________________________

Care Provider’s Name:

___________________________

Provider’s SSN/EIN: __________

Provider’s Address

___________________________

Amt Paid: $_________

Dependent Cared For:

___________________________

Care Provider’s Name:

___________________________

Provider’s SSN/EIN: __________

Provider’s Address

___________________________

Amt Paid: $_________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3