Additional Financial Income - Parent - 2014

ADVERTISEMENT

FVAFP5

2014 - 2015

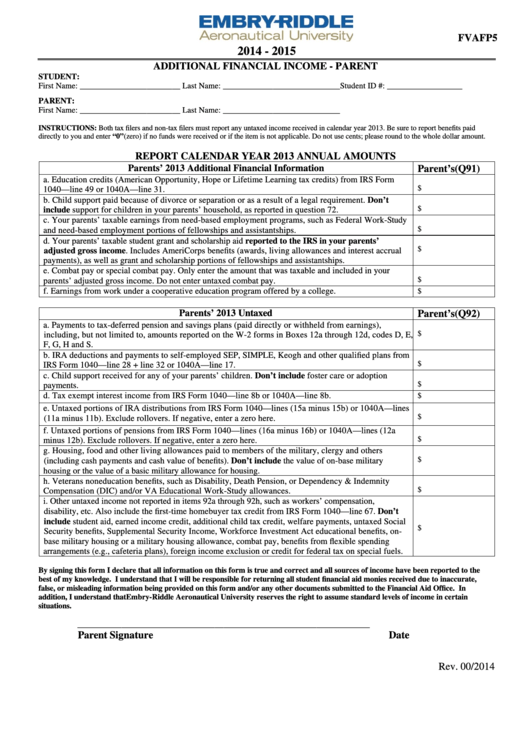

ADDITIONAL FINANCIAL INCOME - PARENT

STUDENT:

First Name: ________________________ Last Name: ____________________________Student ID #: __________________

PARENT:

First Name: ________________________ Last Name: ____________________________

INSTRUCTIONS: Both tax filers and non-tax filers must report any untaxed income received in calendar year 2013. Be sure to report benefits paid

directly to you and enter “0” (zero) if no funds were received or if the item is not applicable. Do not use cents; please round to the whole dollar amount.

REPORT CALENDAR YEAR 2013 ANNUAL AMOUNTS

Parents’ 2013 Additional Financial Information

Parent’s (Q91)

a. Education credits (American Opportunity, Hope or Lifetime Learning tax credits) from IRS Form

$

1040—line 49 or 1040A—line 31.

b. Child support paid because of divorce or separation or as a result of a legal requirement. Don’t

$

include support for children in your parents’ household, as reported in question 72.

c. Your parents’ taxable earnings from need-based employment programs, such as Federal Work-Study

$

and need-based employment portions of fellowships and assistantships.

d. Your parents’ taxable student grant and scholarship aid reported to the IRS in your parents’

$

adjusted gross income. Includes AmeriCorps benefits (awards, living allowances and interest accrual

payments), as well as grant and scholarship portions of fellowships and assistantships.

e. Combat pay or special combat pay. Only enter the amount that was taxable and included in your

$

parents’ adjusted gross income. Do not enter untaxed combat pay.

f. Earnings from work under a cooperative education program offered by a college.

$

Parents’ 2013 Untaxed

Parent’s (Q92)

a. Payments to tax-deferred pension and savings plans (paid directly or withheld from earnings),

$

including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E,

F, G, H and S.

b. IRA deductions and payments to self-employed SEP, SIMPLE, Keogh and other qualified plans from

$

IRS Form 1040—line 28 + line 32 or 1040A—line 17.

c. Child support received for any of your parents’ children. Don’t include foster care or adoption

$

payments.

d. Tax exempt interest income from IRS Form 1040—line 8b or 1040A—line 8b.

$

e. Untaxed portions of IRA distributions from IRS Form 1040—lines (15a minus 15b) or 1040A—lines

$

(11a minus 11b). Exclude rollovers. If negative, enter a zero here.

f. Untaxed portions of pensions from IRS Form 1040—lines (16a minus 16b) or 1040A—lines (12a

$

minus 12b). Exclude rollovers. If negative, enter a zero here.

g. Housing, food and other living allowances paid to members of the military, clergy and others

$

(including cash payments and cash value of benefits). Don’t include the value of on-base military

housing or the value of a basic military allowance for housing.

h. Veterans noneducation benefits, such as Disability, Death Pension, or Dependency & Indemnity

$

Compensation (DIC) and/or VA Educational Work-Study allowances.

i. Other untaxed income not reported in items 92a through 92h, such as workers’ compensation,

disability, etc. Also include the first-time homebuyer tax credit from IRS Form 1040—line 67. Don’t

include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social

$

Security benefits, Supplemental Security Income, Workforce Investment Act educational benefits, on-

base military housing or a military housing allowance, combat pay, benefits from flexible spending

arrangements (e.g., cafeteria plans), foreign income exclusion or credit for federal tax on special fuels.

By signing this form I declare that all information on this form is true and correct and all sources of income have been reported to the

best of my knowledge. I understand that I will be responsible for returning all student financial aid monies received due to inaccurate,

false, or misleading information being provided on this form and/or any other documents submitted to the Financial Aid Office. In

addition, I understand that Embry-Riddle Aeronautical University reserves the right to assume standard levels of income in certain

situations.

__________________________________________________

________________

Parent Signature

Date

Rev. 00/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1