State Of New Mexico Claim Form Flexible Spending Account

ADVERTISEMENT

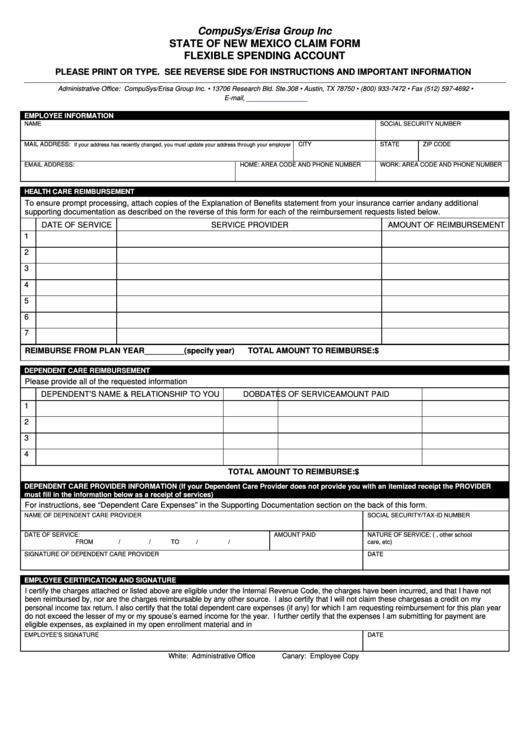

CompuSys/Erisa Group Inc

STATE OF NEW MEXICO CLAIM FORM

FLEXIBLE SPENDING ACCOUNT

PLEASE PRINT OR TYPE. SEE REVERSE SIDE FOR INSTRUCTIONS AND IMPORTANT INFORMATION

Administrative Office: CompuSys/Erisa Group Inc. • 13706 Research Bld. Ste.308 • Austin, TX 78750 • (800) 933-7472 • Fax (512) 597-4692 •

E-mail,

EMPLOYEE INFORMATION

NAME

SOCIAL SECURITY NUMBER

MAIL ADDRESS:

CITY

STATE

ZIP CODE

if your address has recently changed, you must update your address through your employer

EMAIL ADDRESS:

HOME: AREA CODE AND PHONE NUMBER

WORK: AREA CODE AND PHONE NUMBER

HEALTH CARE REIMBURSEMENT

To ensure prompt processing, attach copies of the Explanation of Benefits statement from your insurance carrier and any additional

supporting documentation as described on the reverse of this form for each of the reimbursement requests listed below.

DATE OF SERVICE

SERVICE PROVIDER

AMOUNT OF REIMBURSEMENT

1

2

3

4

5

6

7

REIMBURSE FROM PLAN YEAR_________(specify year)

TOTAL AMOUNT TO REIMBURSE:

$

DEPENDENT CARE REIMBURSEMENT

Please provide all of the requested information

DEPENDENT’S NAME & RELATIONSHIP TO YOU

DOB

DATES OF SERVICE

AMOUNT PAID

1

2

3

4

TOTAL AMOUNT TO REIMBURSE:

$

DEPENDENT CARE PROVIDER INFORMATION (If your Dependent Care Provider does not provide you with an itemized receipt the PROVIDER

must fill in the information below as a receipt of services)

For instructions, see “Dependent Care Expenses” in the Supporting Documentation section on the back of this form.

NAME OF DEPENDENT CARE PROVIDER

SOCIAL SECURITY/TAX-ID NUMBER

DATE OF SERVICE:

AMOUNT PAID

NATURE OF SERVICE: (i.e. day care, other school

FROM

/

/

TO

/

/

care, etc)

SIGNATURE OF DEPENDENT CARE PROVIDER

DATE

EMPLOYEE CERTIFICATION AND SIGNATURE

I certify the charges attached or listed above are eligible under the Internal Revenue Code, the charges have been incurred, and that I have not

been reimbursed by, nor are the charges reimbursable by any other source. I also certify that I will not claim these charges as a credit on my

personal income tax return. I also certify that the total dependent care expenses (if any) for which I am requesting reimbursement for this plan year

do not exceed the lesser of my or my spouse’s earned income for the year. I further certify that the expenses I am submitting for payment are

eligible expenses, as explained in my open enrollment material and in I.R.S. publications 502 and 503.

EMPLOYEE’S SIGNATURE

DATE

White: Administrative Office

Canary: Employee Copy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2