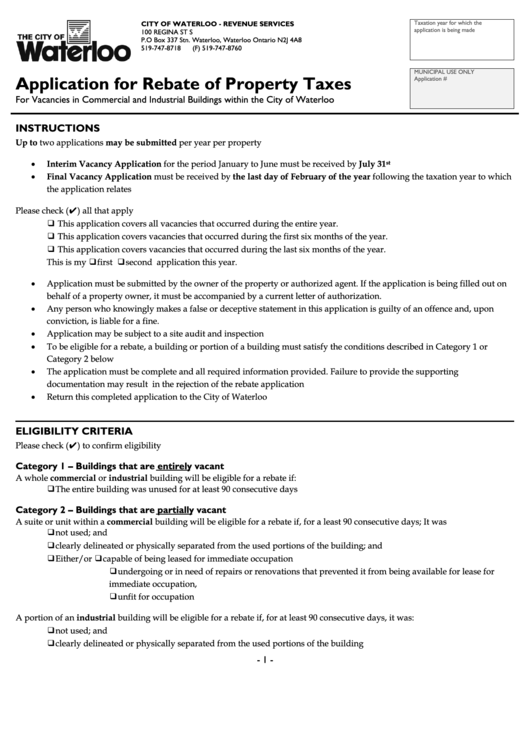

Application Form For Rebate Of Property Taxes

ADVERTISEMENT

Taxation year for which the

CITY OF WATERLOO - REVENUE SERVICES

application is being made

100 REGINA ST S

P.O Box 337 Stn. Waterloo, Waterloo Ontario N2J 4A8

519-747-8718

(F) 519-747-8760

MUNICIPAL USE ONLY

Application for Rebate of Property Taxes

Application #

For Vacancies in Commercial and Industrial Buildings within the City of Waterloo

INSTRUCTIONS

Up to two applications may be submitted per year per property

Interim Vacancy Application for the period January to June must be received by July 31

st

Final Vacancy Application must be received by the last day of February of the year following the taxation year to which

the application relates

Please check (✔) all that apply

❑ This application covers all vacancies that occurred during the entire year.

❑ This application covers vacancies that occurred during the first six months of the year.

❑ This application covers vacancies that occurred during the last six months of the year.

This is my ❑first ❑second application this year.

Application must be submitted by the owner of the property or authorized agent. If the application is being filled out on

behalf of a property owner, it must be accompanied by a current letter of authorization.

Any person who knowingly makes a false or deceptive statement in this application is guilty of an offence and, upon

conviction, is liable for a fine.

Application may be subject to a site audit and inspection

To be eligible for a rebate, a building or portion of a building must satisfy the conditions described in Category 1 or

Category 2 below

The application must be complete and all required information provided. Failure to provide the supporting

documentation may result in the rejection of the rebate application

Return this completed application to the City of Waterloo

ELIGIBILITY CRITERIA

Please check (✔) to confirm eligibility

Category 1 – Buildings that are entirely vacant

A whole commercial or industrial building will be eligible for a rebate if:

❑The entire building was unused for at least 90 consecutive days

Category 2 – Buildings that are partially vacant

A suite or unit within a commercial building will be eligible for a rebate if, for a least 90 consecutive days; It was

❑not used; and

❑clearly delineated or physically separated from the used portions of the building; and

❑capable of being leased for immediate occupation

❑Either/or

❑undergoing or in need of repairs or renovations that prevented it from being available for lease for

immediate occupation,

❑unfit for occupation

A portion of an industrial building will be eligible for a rebate if, for at least 90 consecutive days, it was:

❑not used; and

❑clearly delineated or physically separated from the used portions of the building

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4