Insurance Products Disclosure

ADVERTISEMENT

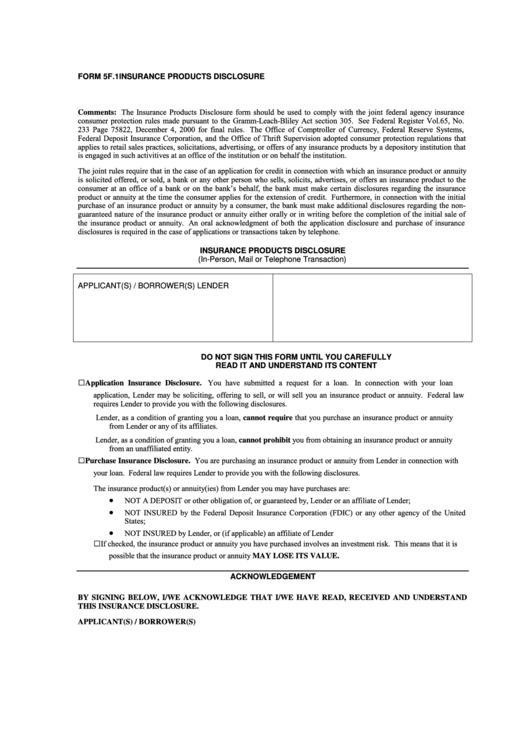

FORM 5F.1 INSURANCE PRODUCTS DISCLOSURE

Comments: The Insurance Products Disclosure form should be used to comply with the joint federal agency insurance

consumer protection rules made pursuant to the Gramm-Leach-Bliley Act section 305. See Federal Register Vol.65, No.

233 Page 75822, December 4, 2000 for final rules. The Office of Comptroller of Currency, Federal Reserve Systems,

Federal Deposit Insurance Corporation, and the Office of Thrift Supervision adopted consumer protection regulations that

applies to retail sales practices, solicitations, advertising, or offers of any insurance products by a depository institution that

is engaged in such activitives at an office of the institution or on behalf the institution.

The joint rules require that in the case of an application for credit in connection with which an insurance product or annuity

is solicited offered, or sold, a bank or any other person who sells, solicits, advertises, or offers an insurance product to the

consumer at an office of a bank or on the bank’s behalf, the bank must make certain disclosures regarding the insurance

product or annuity at the time the consumer applies for the extension of credit. Furthermore, in connection with the initial

purchase of an insurance product or annuity by a consumer, the bank must make additional disclosures regarding the non-

guaranteed nature of the insurance product or annuity either orally or in writing before the completion of the initial sale of

the insurance product or annuity. An oral acknowledgment of both the application disclosure and purchase of insurance

disclosures is required in the case of applications or transactions taken by telephone.

INSURANCE PRODUCTS DISCLOSURE

(In-Person, Mail or Telephone Transaction)

APPLICANT(S) / BORROWER(S)

LENDER

DO NOT SIGN THIS FORM UNTIL YOU CAREFULLY

READ IT AND UNDERSTAND ITS CONTENT

□

You have submitted a request for a loan.

In connection with your loan

Application Insurance Disclosure.

application, Lender may be soliciting, offering to sell, or will sell you an insurance product or annuity. Federal law

requires Lender to provide you with the following disclosures.

Lender, as a condition of granting you a loan, cannot require that you purchase an insurance product or annuity

from Lender or any of its affiliates.

Lender, as a condition of granting you a loan, cannot prohibit you from obtaining an insurance product or annuity

from an unaffiliated entity.

□

Purchase Insurance Disclosure. You are purchasing an insurance product or annuity from Lender in connection with

your loan. Federal law requires Lender to provide you with the following disclosures.

The insurance product(s) or annuity(ies) from Lender you may have purchases are:

•

NOT A DEPOSIT or other obligation of, or guaranteed by, Lender or an affiliate of Lender;

•

NOT INSURED by the Federal Deposit Insurance Corporation (FDIC) or any other agency of the United

States;

•

NOT INSURED by Lender, or (if applicable) an affiliate of Lender

□

If checked, the insurance product or annuity you have purchased involves an investment risk. This means that it is

possible that the insurance product or annuity MAY LOSE ITS VALUE.

ACKNOWLEDGEMENT

BY SIGNING BELOW, I/WE ACKNOWLEDGE THAT I/WE HAVE READ, RECEIVED AND UNDERSTAND

THIS INSURANCE DISCLOSURE.

APPLICANT(S) / BORROWER(S)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2