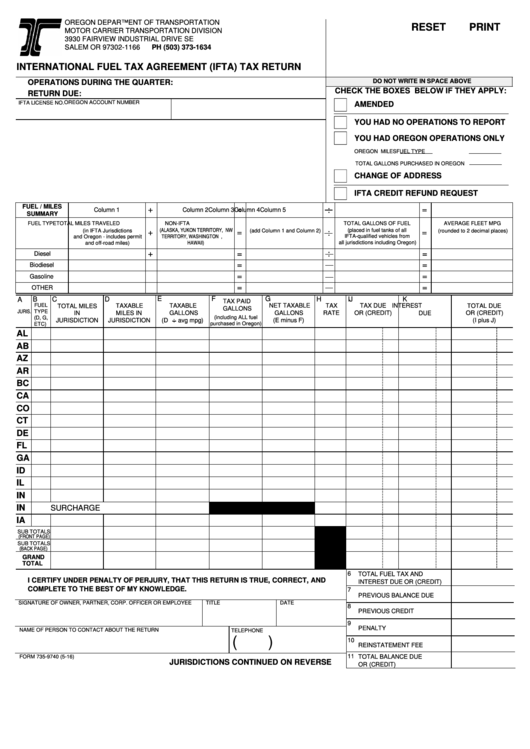

OREGON DEPARTMENT OF TRANSPORTATION

RESET

PRINT

MOTOR CARRIER TRANSPORTATION DIVISION

3930 FAIRVIEW INDUSTRIAL DRIVE SE

SALEM OR 97302-1166

PH (503) 373-1634

INTERNATIONAL FUEL TAX AGREEMENT (IFTA) TAX RETURN

DO NOT WRITE IN SPACE ABOVE

OPERATIONS DURING THE QUARTER:

CHECK THE BOXES BELOW IF THEY APPLY:

RETURN DUE:

OREGON ACCOUNT NUMBER

IFTA LICENSE NO.

AMENDED

YOU HAD NO OPERATIONS TO REPORT

YOU HAD OREGON OPERATIONS ONLY

OREGON MILES

FUEL TYPE

TOTAL GALLONS PURCHASED IN OREGON

CHANGE OF ADDRESS

IFTA CREDIT REFUND REQUEST

FUEL / MILES

+

=

=

:

Column 1

Column 2

Column 3

Column 4

Column 5

SUMMARY

TOTAL MILES TRAVELED

NON-IFTA JURISD.MILES

TOTAL MILES

TOTAL GALLONS OF FUEL

AVERAGE FLEET MPG

FUEL TYPE

(ALASKA, YUKON TERRITORY, NW

(placed in fuel tanks of all

(in IFTA Jurisdictions

(add Column 1 and Column 2)

+

=

=

(rounded to 2 decimal places)

:

TERRITORY, WASHINGTON D.C.,

IFTA-qualified vehicles from

and Oregon - includes permit

HAWAII)

all jurisdictions including Oregon)

and off-road miles)

+

=

:

=

Diesel

+

=

:

=

Biodiesel

+

=

=

:

Gasoline

+

=

:

=

OTHER

E

F

G

B

C

D

H

I

J

K

A

FUEL

TAXABLE

TAXABLE

NET TAXABLE

TAX

TAX DUE

INTEREST

TOTAL DUE

TOTAL MILES

TAX PAID

JURIS.

TYPE

GALLONS

GALLONS

RATE

OR (CREDIT)

DUE

IN

MILES IN

OR (CREDIT)

GALLONS

(D, G,

JURISDICTION

(E minus F)

(I plus J)

JURISDICTION

(D : avg mpg)

ETC)

AL

AB

AZ

AR

BC

CA

CO

CT

DE

FL

GA

ID

IL

IN

IN

SURCHARGE

IA

SUB TOTALS

(FRONT PAGE)

SUB TOTALS

(BACK PAGE)

GRAND

TOTAL

6

TOTAL FUEL TAX AND

I CERTIFY UNDER PENALTY OF PERJURY, THAT THIS RETURN IS TRUE, CORRECT, AND

INTEREST DUE OR (CREDIT)

COMPLETE TO THE BEST OF MY KNOWLEDGE.

7

PREVIOUS BALANCE DUE

SIGNATURE OF OWNER, PARTNER, CORP. OFFICER OR EMPLOYEE

TITLE

DATE

8

PREVIOUS CREDIT

9

PENALTY

NAME OF PERSON TO CONTACT ABOUT THE RETURN

TELEPHONE

(

)

10

REINSTATEMENT FEE

11

FORM 735-9740 (7-16)

TOTAL BALANCE DUE

JURISDICTIONS CONTINUED ON REVERSE

OR (CREDIT)

1

1 2

2 3

3 4

4