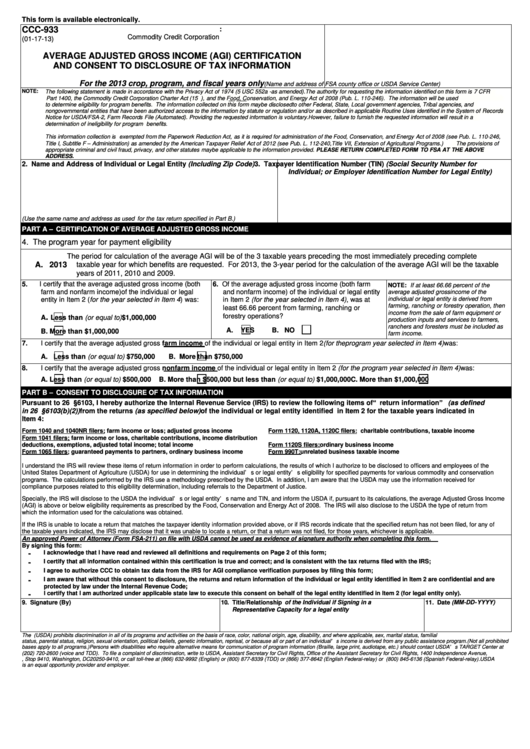

This form is available electronically.

CCC-933

U.S. DEPARTMENT OF AGRICULTURE

1. Return completed form to:

Commodity Credit Corporation

(01-17-13)

AVERAGE ADJUSTED GROSS INCOME (AGI) CERTIFICATION

AND CONSENT TO DISCLOSURE OF TAX INFORMATION

For the 2013 crop, program, and fiscal years only

(Name and address of FSA county office or USDA Service Center)

NOTE:

The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on this form is 7 CFR

Part 1400, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et.seq.), and the Food, Conservation, and Energy Act of 2008 (Pub. L. 110-246). The information will be used

to determine eligibility for program benefits. The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and

nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records

Notice for USDA/FSA-2, Farm Records File (Automated). Providing the requested information is voluntary. However, failure to furnish the requested information will result in a

determination of ineligibility for program benefits.

This information collection is exempted from the Paperwork Reduction Act, as it is required for administration of the Food, Conservation, and Energy Act of 2008 (see Pub. L. 110-246,

Title I, Subtitle F –Administration) as amended by the American Taxpayer Relief Act of 2012 (see Pub. L. 112-240, Title VII, Extension of Agricultural Programs.)

The provisions of

appropriate criminal and civil fraud, privacy, and other statutes may be applicable to the information provided. PLEASE RETURN COM PLETED FORM TO FSA AT THE ABO VE

ADDRESS.

2. Name and Address of Individual or Legal Entity (Including Zip Code)

3. Taxpayer Identification Number (TIN) (Social Security Number for

Individual; or Employer Identification Number for Legal Entity)

(Use the same name and address as used for the tax return specified in Part B.)

PART A –CERTIFICATION OF AVERAGE ADJUSTED GROSS INCOME

4. The program year for payment eligibility

The period for calculation of the average AGI will be of the 3 taxable years preceding the most immediately preceding complete

A. 2013

taxable year for which benefits are requested. For 2013, the 3-year period for the calculation of the average AGI will be the taxable

years of 2011, 2010 and 2009.

5.

I I certify that the average adjusted gross income (both

6. Of the average adjusted gross income (both farm

NOTE: If at least 66.66 percent of the

farm and nonfarm income) of the individual or legal

and nonfarm income) of the individual or legal entity

average adjusted gross income of the

entity in Item 2 (for the year selected in Item 4) was:

in Item 2 (for the year selected in Item 4), was at

individual or legal entity is derived from

farming, ranching or forestry operation, then

least 66.66 percent from farming, ranching or

income from the sale of farm equipment or

.

forestry operations?

A

Less than (or equal to) $1,000,000

production inputs and services to farmers,

ranchers and foresters must be included as

A.

YES

B.

NO

B.

More than $1,000,000

farm income.

7.

I certify that the average adjusted gross farm income of the individual or legal entity in Item 2 (for the program year selected in Item 4) was:

A.

Less than (or equal to) $750,000

B.

More than $750,000

8.

I certify that the average adjusted gross nonfarm income of the individual or legal entity in Item 2 (for the program year selected in Item 4) was:

A.

Less than (or equal to) $500,000

B.

More than $500,000 but less than (or equal to) $1,000,000

C.

More than $1,000,000

PART B –CONSENT TO DISCLOSURE OF TAX INFORMATION

Pursuant to 26 U.S.C. §6103, I hereby authorize the Internal Revenue Service (IRS) to review the following items of “ return information” (as defined

in 26 U.S.C. §6103(b)(2)) from the returns (as specified below) of the individual or legal entity identified in Item 2 for the taxable years indicated in

Item 4:

Form 1040 and 1040NR filers; farm income or loss; adjusted gross income

Form 1120, 1120A, 1120C filers: charitable contributions, taxable income

Form 1041 filers; farm income or loss, charitable contributions, income distribution

deductions, exemptions, adjusted total income; total income

Form 1120S filers: ordinary business income

Form 1065 filers; guaranteed payments to partners, ordinary business income

Form 990T: unrelated business taxable income

I understand the IRS will review these items of return information in order to perform calculations, the results of which I authorize to be disclosed to officers and employees of the

United States Department of Agriculture (USDA) for use in determining the individual’ s or legal entity’ s eligibility for specified payments for various commodity and conservation

programs. The calculations performed by the IRS use a methodology prescribed by the USDA. In addition, I am aware that the USDA may use the information received for

compliance purposes related to this eligibility determination, including referrals to the Department of Justice.

Specially, the IRS will disclose to the USDA the individual’ s or legal entity’ s name and TIN, and inform the USDA if, pursuant to its calculations, the average Adjusted Gross Income

(AGI) is above or below eligibility requirements as prescribed by the Food, Conservation and Energy Act of 2008. The IRS will also disclose to the USDA the type of return from

which the information used for the calculations was obtained.

If the IRS is unable to locate a return that matches the taxpayer identity information provided above, or if IRS records indicate that the specified return has not been filed, for any of

the taxable years indicated, the IRS may disclose that it was unable to locate a return, or that a return was not filed, for those years, whichever is applicable.

An approved Power of Attorney (Form FSA-211) on file with USDA cannot be used as evidence of signature authority when completing this form.

By signing this form:

-

I acknowledge that I have read and reviewed all definitions and requirements on Page 2 of this form;

I certify that all information contained within this certification is true and correct; and is consistent with the tax returns filed with the IRS;

-

I agree to authorize CCC to obtain tax data from the IRS for AGI compliance verification purposes by filing this form;

-

-

I am aware that without this consent to disclosure, the returns and return information of the individual or legal entity identified in Item 2 are confidential and are

protected by law under the Internal Revenue Code;

-

I certify that I am authorized under applicable state law to execute this consent on behalf of the legal entity identified in Item 2 (for legal entity only).

9. Signature (By)

10. Title/Relationship of the Individual if Signing in a

11. Date (MM-DD-YYYY)

Representative Capacity for a legal entity

The U.S. Department of Agriculture (USDA) prohibits discrimination in all of its programs and activities on the basis of race, color, national origin, age, disability, and where applicable, sex, marital status, familial

status, parental status, religion, sexual orientation, political beliefs, genetic information, reprisal, or because all or part of an individual’ s income is derived from any public assistance program. (Not all prohibited

bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA’ s TARGET Center at

(202) 720-2600 (voice and TDD). To file a complaint of discrimination, write to USDA, Assistant Secretary for Civil Rights, Office of the Assistant Secretary for Civil Rights, 1400 Independence Avenue,

S.W., Stop 9410, Washington, DC 20250-9410, or call toll-free at (866) 632-9992 (English) or (800) 877-8339 (TDD) or (866) 377-8642 (English Federal-relay) or (800) 845-6136 (Spanish Federal-relay). USDA

is an equal opportunity provider and employer.

1

1 2

2