Sample Authorization Letter - Florida Department Of Revenue

ADVERTISEMENT

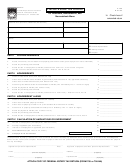

STATE OF FLORIDA

DEPARTMENT OF REVENUE

TALLAHASSEE, FLORIDA 32399-0100

General Tax Administration

Child Support Enforcement

Property Tax Administration

Jim Zingale

SAMPLE

Administrative Services

Executive Director

Information Services

THIS AUTHORIZES:

Control Number: _____________________________________

NAME OF AIR CARRIER:

____________________________________________

Effective Date: ______________________________________

ADDRESS OF AIR CARRIER:

___________________________________________

Expiration Date: _____________________________________

CITY/STATE OF AIR CARRIER: ___________________________________________

Air Carrier License Number: ___________________________

This authorization letter is issued to: ______________________________________________ for the purpose

of purchasing aviation fuel exempt from aviation fuel tax. The Department of Revenue is authorized to notify a

qualifying air carrier when the provisions of Section 206.9825(1)(b), Florida Statutes, are met by the carrier.

This letter is valid for all sales of aviation fuel between aviation fuel terminal suppliers or wholesalers and the

holder for the time period between this letter’s effective and expiration dates.

A photocopy of this letter must be given to each aviation fuel terminal supplier or wholesaler from which the

holder purchases aviation fuel. Aviation fuel terminal suppliers and wholesalers must maintain a copy of this

letter in their records as documentation for omitting aviation fuel tax from billings issued to the qualifying air

carrier.

The name of the air carrier’s aviation fuel terminal supplier or wholesaler, the date on which the letter is

executed, and the signature of an official of the air carrier are required for proper execution.

NOTE: If, after May 1, 2002, the number of full-time equivalent employee positions created or added to

the air carrier’s workforce falls below 250, the exemption granted shall not apply during the period in

which the air carrier has fewer than the 250 additional employees. Further, the air carrier must notify

the Department immediately when the criteria are no longer met. Qualification of an air carrier’s

exemption is subject to audit by the Department of Revenue for the periods specified in subsection

95.091(3), Florida Statutes.

_______________________________________

__________________________________________

DOR Official Name and Title

Name of Terminal Supplier or Wholesaler

_______________________________________

__________________________________________

Signature of Florida Department of Revenue Official

Signature of Air Carrier Official

(Owner, Partner, Officer, or Authorized Representative)

_______________________________________

__________________________________________

Date

Date

Tallahassee, Florida 32399-0100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1