Swain County Occupancy Tax Report

ADVERTISEMENT

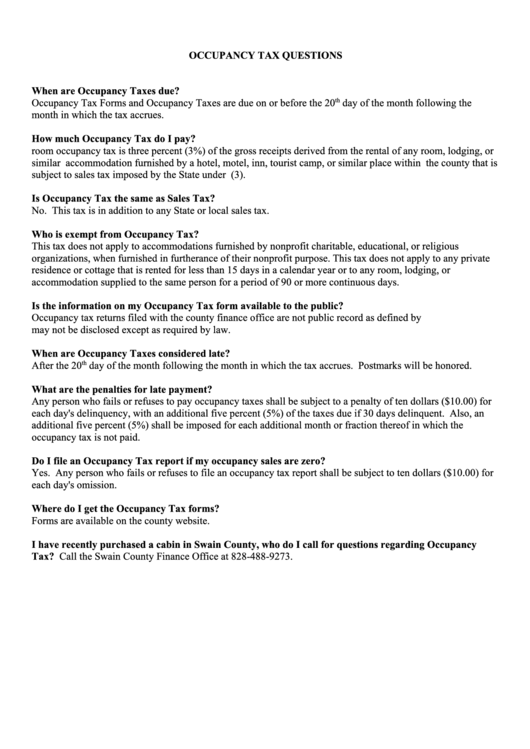

OCCUPANCY TAX QUESTIONS

When are Occupancy Taxes due?

Occupancy Tax Forms and Occupancy Taxes are due on or before the 20

th

day of the month following the

month in which the tax accrues.

How much Occupancy Tax do I pay?

room occupancy tax is three percent (3%) of the gross receipts derived from the rental of any room, lodging, or

similar accommodation furnished by a hotel, motel, inn, tourist camp, or similar place within the county that is

subject to sales tax imposed by the State under G.S. 105- 164.4(3).

Is Occupancy Tax the same as Sales Tax?

No. This tax is in addition to any State or local sales tax.

Who is exempt from Occupancy Tax?

This tax does not apply to accommodations furnished by nonprofit charitable, educational, or religious

organizations, when furnished in furtherance of their nonprofit purpose. This tax does not apply to any private

residence or cottage that is rented for less than 15 days in a calendar year or to any room, lodging, or

accommodation supplied to the same person for a period of 90 or more continuous days.

Is the information on my Occupancy Tax form available to the public?

Occupancy tax returns filed with the county finance office are not public record as defined by G.S. 132-1 and

may not be disclosed except as required by law.

When are Occupancy Taxes considered late?

After the 20

th

day of the month following the month in which the tax accrues. Postmarks will be honored.

What are the penalties for late payment?

Any person who fails or refuses to pay occupancy taxes shall be subject to a penalty of ten dollars ($10.00) for

each day's delinquency, with an additional five percent (5%) of the taxes due if 30 days delinquent. Also, an

additional five percent (5%) shall be imposed for each additional month or fraction thereof in which the

occupancy tax is not paid.

Do I file an Occupancy Tax report if my occupancy sales are zero?

Yes. Any person who fails or refuses to file an occupancy tax report shall be subject to ten dollars ($10.00) for

each day's omission.

Where do I get the Occupancy Tax forms?

Forms are available on the county website. swaincountync.gov

I have recently purchased a cabin in Swain County, who do I call for questions regarding Occupancy

Tax? Call the Swain County Finance Office at 828-488-9273.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4