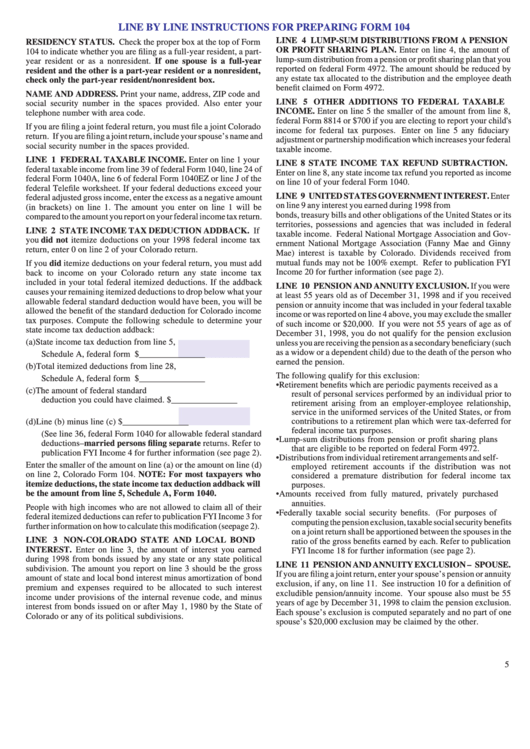

Line By Line Instructions For Preparing Form 104

ADVERTISEMENT

LINE BY LINE INSTRUCTIONS FOR PREPARING FORM 104

LINE 4 LUMP-SUM DISTRIBUTIONS FROM A PENSION

RESIDENCY STATUS. Check the proper box at the top of Form

OR PROFIT SHARING PLAN. Enter on line 4, the amount of

104 to indicate whether you are filing as a full-year resident, a part-

lump-sum distribution from a pension or profit sharing plan that you

year resident or as a nonresident. If one spouse is a full-year

reported on federal Form 4972. The amount should be reduced by

resident and the other is a part-year resident or a nonresident,

any estate tax allocated to the distribution and the employee death

check only the part-year resident/nonresident box.

benefit claimed on Form 4972.

NAME AND ADDRESS. Print your name, address, ZIP code and

LINE 5 OTHER ADDITIONS TO FEDERAL TAXABLE

social security number in the spaces provided. Also enter your

INCOME. Enter on line 5 the smaller of the amount from line 8,

telephone number with area code.

federal Form 8814 or $700 if you are electing to report your child's

If you are filing a joint federal return, you must file a joint Colorado

income for federal tax purposes. Enter on line 5 any fiduciary

return. If you are filing a joint return, include your spouse’s name and

adjustment or partnership modification which increases your federal

social security number in the spaces provided.

taxable income.

LINE 1 FEDERAL TAXABLE INCOME. Enter on line 1 your

LINE 8 STATE INCOME TAX REFUND SUBTRACTION.

federal taxable income from line 39 of federal Form 1040, line 24 of

Enter on line 8, any state income tax refund you reported as income

federal Form 1040A, line 6 of federal Form 1040EZ or line J of the

on line 10 of your federal Form 1040.

federal Telefile worksheet. If your federal deductions exceed your

LINE 9 UNITED STATES GOVERNMENT INTEREST. Enter

federal adjusted gross income, enter the excess as a negative amount

on line 9 any interest you earned during 1998 from U.S. government

(in brackets) on line 1. The amount you enter on line 1 will be

bonds, treasury bills and other obligations of the United States or its

compared to the amount you report on your federal income tax return.

territories, possessions and agencies that was included in federal

LINE 2 STATE INCOME TAX DEDUCTION ADDBACK. If

taxable income. Federal National Mortgage Association and Gov-

you did not itemize deductions on your 1998 federal income tax

ernment National Mortgage Association (Fanny Mae and Ginny

return, enter 0 on line 2 of your Colorado return.

Mae) interest is taxable by Colorado. Dividends received from

mutual funds may not be 100% exempt. Refer to publication FYI

If you did itemize deductions on your federal return, you must add

Income 20 for further information (see page 2).

back to income on your Colorado return any state income tax

included in your total federal itemized deductions. If the addback

LINE 10 PENSION AND ANNUITY EXCLUSION. If you were

causes your remaining itemized deductions to drop below what your

at least 55 years old as of December 31, 1998 and if you received

allowable federal standard deduction would have been, you will be

pension or annuity income that was included in your federal taxable

allowed the benefit of the standard deduction for Colorado income

income or was reported on line 4 above, you may exclude the smaller

tax purposes. Compute the following schedule to determine your

of such income or $20,000. If you were not 55 years of age as of

state income tax deduction addback:

December 31, 1998, you do not qualify for the pension exclusion

(a) State income tax deduction from line 5,

unless you are receiving the pension as a secondary beneficiary (such

as a widow or a dependent child) due to the death of the person who

Schedule A, federal form 1040 ....... $ _______________

earned the pension.

(b) Total itemized deductions from line 28,

The following qualify for this exclusion:

Schedule A, federal form 1040 ....... $ _______________

•

Retirement benefits which are periodic payments received as a

(c) The amount of federal standard

result of personal services performed by an individual prior to

deduction you could have claimed . $ _______________

retirement arising from an employer-employee relationship,

service in the uniformed services of the United States, or from

contributions to a retirement plan which were tax-deferred for

(d) Line (b) minus line (c) .................... $ _______________

federal income tax purposes.

(See line 36, federal Form 1040 for allowable federal standard

•

Lump-sum distributions from pension or profit sharing plans

deductions–married persons filing separate returns. Refer to

that are eligible to be reported on federal Form 4972.

publication FYI Income 4 for further information (see page 2).

•

Distributions from individual retirement arrangements and self-

Enter the smaller of the amount on line (a) or the amount on line (d)

employed retirement accounts if the distribution was not

on line 2, Colorado Form 104. NOTE: For most taxpayers who

considered a premature distribution for federal income tax

itemize deductions, the state income tax deduction addback will

purposes.

be the amount from line 5, Schedule A, Form 1040.

•

Amounts received from fully matured, privately purchased

annuities.

People with high incomes who are not allowed to claim all of their

•

Federally taxable social security benefits. (For purposes of

federal itemized deductions can refer to publication FYI Income 3 for

computing the pension exclusion, taxable social security benefits

further information on how to calculate this modification (see page 2).

on a joint return shall be apportioned between the spouses in the

LINE 3 NON-COLORADO STATE AND LOCAL BOND

ratio of the gross benefits earned by each. Refer to publication

INTEREST. Enter on line 3, the amount of interest you earned

FYI Income 18 for further information (see page 2).

during 1998 from bonds issued by any state or any state political

LINE 11 PENSION AND ANNUITY EXCLUSION – SPOUSE.

subdivision. The amount you report on line 3 should be the gross

If you are filing a joint return, enter your spouse’s pension or annuity

amount of state and local bond interest minus amortization of bond

exclusion, if any, on line 11. See instruction 10 for a definition of

premium and expenses required to be allocated to such interest

excludible pension/annuity income. Your spouse also must be 55

income under provisions of the internal revenue code, and minus

years of age by December 31, 1998 to claim the pension exclusion.

interest from bonds issued on or after May 1, 1980 by the State of

Each spouse’s exclusion is computed separately and no part of one

Colorado or any of its political subdivisions.

spouse’s $20,000 exclusion may be claimed by the other.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2