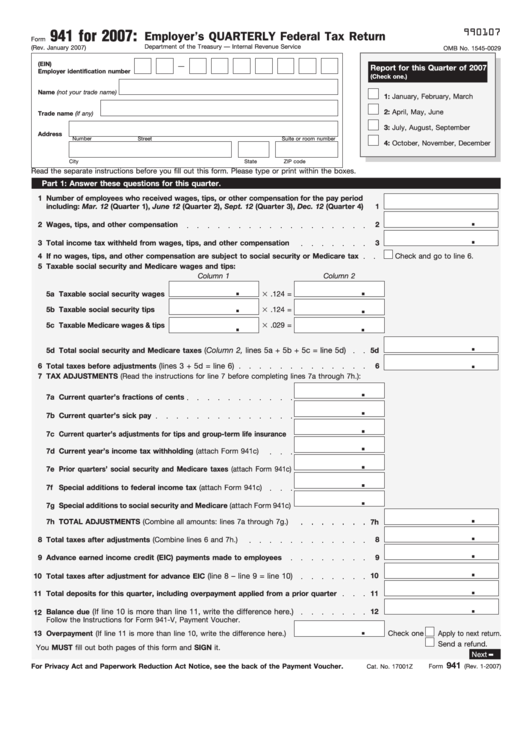

990107

941 for 2007:

Employer’s QUARTERLY Federal Tax Return

Form

Department of the Treasury — Internal Revenue Service

(Rev. January 2007)

OMB No. 1545-0029

(EIN)

—

Report for this Quarter of 2007

Employer identification number

(Check one.)

Name (not your trade name)

1: January, February, March

2: April, May, June

Trade name (if any)

3: July, August, September

Address

Number

Street

Suite or room number

4: October, November, December

City

State

ZIP code

Read the separate instructions before you fill out this form. Please type or print within the boxes.

Part 1: Answer these questions for this quarter.

1

Number of employees who received wages, tips, or other compensation for the pay period

including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), Dec. 12 (Quarter 4)

1

.

2

Wages, tips, and other compensation

2

.

3

Total income tax withheld from wages, tips, and other compensation

3

4

If no wages, tips, and other compensation are subject to social security or Medicare tax

Check and go to line 6.

5

Taxable social security and Medicare wages and tips:

Column 1

Column 2

.

.

5a

Taxable social security wages

.124 =

.

.

5b

Taxable social security tips

.124 =

.

.

5c

Taxable Medicare wages & tips

.029 =

.

(Column 2, lines 5a + 5b + 5c = line 5d)

5d

Total social security and Medicare taxes

5d

.

(lines 3 + 5d = line 6)

6

Total taxes before adjustments

6

7

TAX ADJUSTMENTS (Read the instructions for line 7 before completing lines 7a through 7h.):

.

7a

Current quarter’s fractions of cents

.

7b

Current quarter’s sick pay

.

7c

Current quarter’s adjustments for tips and group-term life insurance

.

7d

Current year’s income tax withholding (attach Form 941c)

.

7e

Prior quarters’ social security and Medicare taxes (attach Form 941c)

.

7f

Special additions to federal income tax (attach Form 941c)

.

7g

Special additions to social security and Medicare (attach Form 941c)

.

7h

TOTAL ADJUSTMENTS (Combine all amounts: lines 7a through 7g.)

7h

.

8

Total taxes after adjustments (Combine lines 6 and 7h.)

8

.

9

9

Advance earned income credit (EIC) payments made to employees

.

10

Total taxes after adjustment for advance EIC

(line 8 – line 9 = line 10)

10

.

11

Total deposits for this quarter, including overpayment applied from a prior quarter

11

.

(If line 10 is more than line 11, write the difference here.)

Balance due

12

12

Follow the Instructions for Form 941-V, Payment Voucher.

.

13

Overpayment (If line 11 is more than line 10, write the difference here.)

Check one

Apply to next return.

Send a refund.

You MUST fill out both pages of this form and SIGN it.

Next

941

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher.

Cat. No. 17001Z

Form

(Rev. 1-2007)

1

1 2

2 3

3 4

4