Sales And Use Tax Nys Worksheet

ADVERTISEMENT

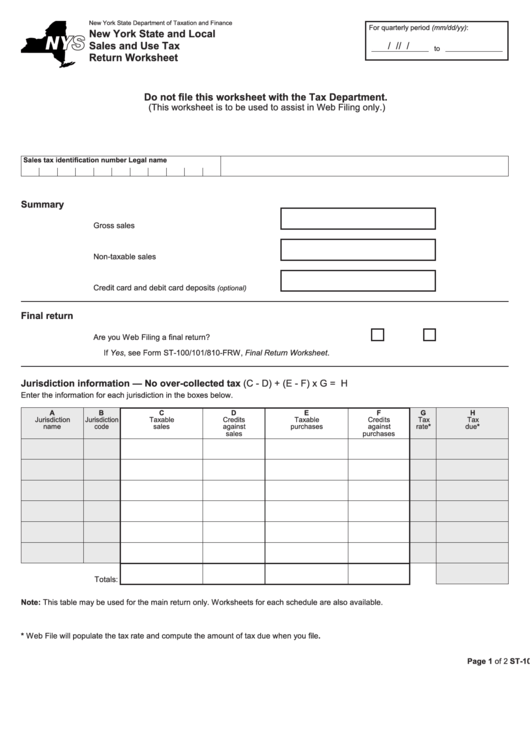

New York State Department of Taxation and Finance

For quarterly period (mm/dd/yy):

New York State and Local

Sales and Use Tax

/

/

/

/

to

Return Worksheet

Do not file this worksheet with the Tax Department.

(This worksheet is to be used to assist in Web Filing only.)

Sales tax identification number

Legal name

Summary

Gross sales ................................................................

Non-taxable sales ......................................................

Credit card and debit card deposits

.............

(optional)

Final return

Are you Web Filing a final return? ................................................................ Yes

No

If Yes, see Form ST-100/101/810-FRW, Final Return Worksheet.

Jurisdiction information — No over-collected tax (C - D) + (E - F) x G = H

Enter the information for each jurisdiction in the boxes below.

A

B

C

D

E

F

G

H

Jurisdiction

Jurisdiction

Taxable

Credits

Taxable

Credits

Tax

Tax

name

code

sales

against

purchases

against

rate*

due*

sales

purchases

Totals:

Note: This table may be used for the main return only. Worksheets for each schedule are also available.

* Web File will populate the tax rate and compute the amount of tax due when you file.

ST-100/101/810-WS (9/13)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2