Biaw Health Insurance Trust Employer Participation Agreement

ADVERTISEMENT

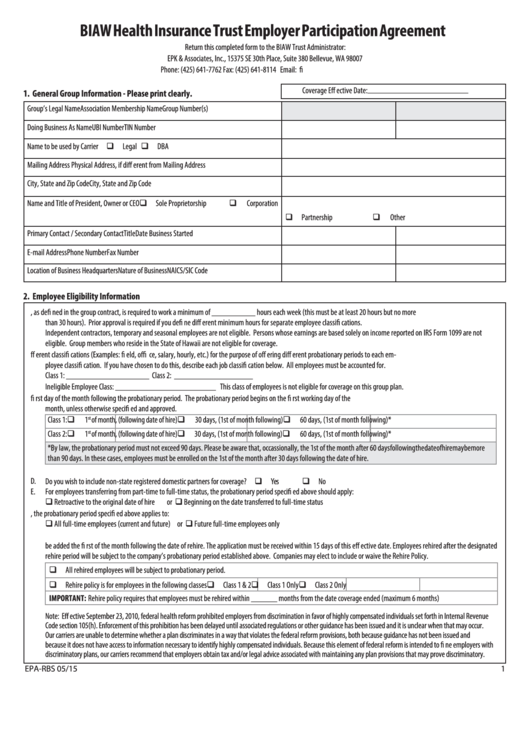

BIAW Health Insurance Trust Employer Participation Agreement

Return this completed form to the BIAW Trust Administrator:

EPK & Associates, Inc., 15375 SE 30th Place, Suite 380 Bellevue, WA 98007

Phone: (425) 641-7762 Fax: (425) 641-8114 Email: renewal@epkbenefi

Coverage Eff ective Date: _______________________

1. General Group Information - Please print clearly.

Group’s Legal Name

Association Membership Name

Group Number(s)

Doing Business As Name

UBI Number

TIN Number

Name to be used by Carrier Legal DBA

Mailing Address

Physical Address, if diff erent from Mailing Address

City, State and Zip Code

City, State and Zip Code

Sole Proprietorship

Corporation

Name and Title of President, Owner or CEO

Partnership

Other

Primary Contact / Secondary Contact

Title

Date Business Started

E-mail Address

Phone Number

Fax Number

Location of Business Headquarters

Nature of Business

NAICS/SIC Code

2. Employee Eligibility Information

A. An eligible employee, as defi ned in the group contract, is required to work a minimum of __________ hours each week (this must be at least 20 hours but no more

than 30 hours). Prior approval is required if you defi ne diff erent minimum hours for separate employee classifi cations.

Independent contractors, temporary and seasonal employees are not eligible. Persons whose earnings are based solely on income reported on IRS Form 1099 are not

eligible. Group members who reside in the State of Hawaii are not eligible for coverage.

B.

Groups may list employees in diff erent classifi cations (Examples: fi eld, offi ce, salary, hourly, etc.) for the purpose of off ering diff erent probationary periods to each em-

ployee classifi cation. If you have chosen to do this, describe each job classifi cation below. All employees must be accounted for.

Class 1: ___________________ Class 2: __________________

Ineligible Employee Class: _______________________ This class of employees is not eligible for coverage on this group plan.

C.

Employees will be eligible for coverage on the fi rst day of the month following the probationary period. The probationary period begins on the fi rst working day of the

month, unless otherwise specifi ed and approved.

1

30 days, (1st of month following)

st

Class 1:

of month, (following date of hire)

60 days, (1st of month following)*

1

60 days, (1st of month following)*

st

Class 2:

of month, (following date of hire)

30 days, (1st of month following)

*By law, the probationary period must not exceed 90 days. Please be aware that, occassionally, the 1st of the month after 60 days following the date of hire may be more

than 90 days. In these cases, employees must be enrolled on the 1st of the month after 30 days following the date of hire.

Do you wish to include non-state registered domestic partners for coverage? Yes

No

D.

E.

For employees transferring from part-time to full-time status, the probationary period specifi ed above should apply:

Retroactive to the original date of hire

Beginning on the date transferred to full-time status

or

F.

For new groups, the probationary period specifi ed above applies to:

All full-time employees (current and future)

Future full-time employees only

or

G. The Rehire Policy applies only to employees that were covered under the plan at the time their employment was terminated. Employees subject to the rehire policy must

be added the fi rst of the month following the date of rehire. The application must be received within 15 days of this eff ective date. Employees rehired after the designated

rehire period will be subject to the company’s probationary period established above. Companies may elect to include or waive the Rehire Policy.

All rehired employees will be subject to probationary period.

Rehire policy is for employees in the following classes

Class 1 & 2

Class 1 Only

Class 2 Only

IMPORTANT: Rehire policy requires that employees must be rehired within ______ months from the date coverage ended (maximum 6 months)

Note: Eff ective September 23, 2010, federal health reform prohibited employers from discrimination in favor of highly compensated individuals set forth in Internal Revenue

Code section 105(h). Enforcement of this prohibition has been delayed until associated regulations or other guidance has been issued and it is unclear when that may occur.

Our carriers are unable to determine whether a plan discriminates in a way that violates the federal reform provisions, both because guidance has not been issued and

because it does not have access to information necessary to identify highly compensated individuals. Because this element of federal reform is intended to fi ne employers with

discriminatory plans, our carriers recommend that employers obtain tax and/or legal advice associated with maintaining any plan provisions that may prove discriminatory.

EPA-RBS 05/15

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4