Ohio Public Employees Retirement System

Page _______of ________

277 East Town Street, Columbus, Ohio 43215-4642, 1-888-400-0965,

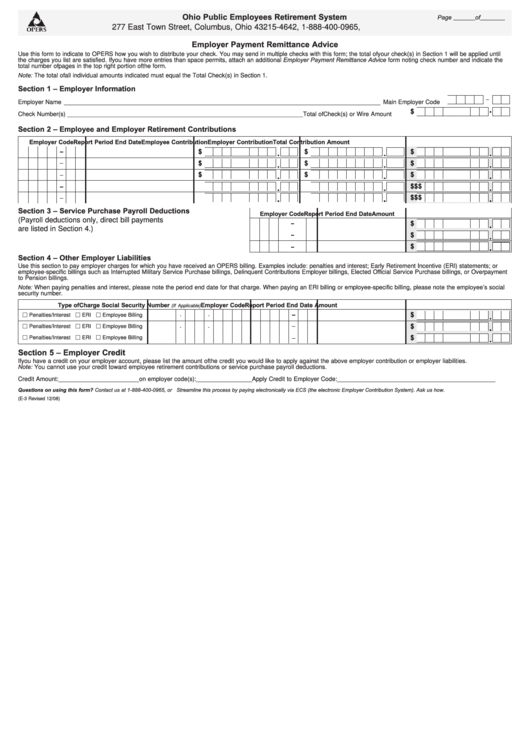

Employer Payment Remittance Advice

Use this form to indicate to OPERS how you wish to distribute your check. You may send in multiple checks with this form; the total of your check(s) in Section 1 will be applied until

the charges you list are satisfied. If you have more entries than space permits, attach an additional Employer Payment Remittance Advice form noting check number and indicate the

total number of pages in the top right portion of the form.

Note: The total of all individual amounts indicated must equal the Total Check(s) in Section 1.

Section 1 – Employer Information

Employer Name ______________________________________________________________________________________________________

Main Employer Code

$

Check Number(s) ____________________________________________________________________________

Total of Check(s) or Wire Amount

Section 2 – Employee and Employer Retirement Contributions

Employer Code

Report Period End Date

Employee Contribution

Employer Contribution

Total Contribution Amount

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Section 3 – Service Purchase Payroll Deductions

Employer Code

Report Period End Date

Amount

(Payroll deductions only, direct bill payments

$

are listed in Section 4.)

$

$

Section 4 – Other Employer Liabilities

Use this section to pay employer charges for which you have received an OPERS billing. Examples include: penalties and interest; Early Retirement Incentive (ERI) statements; or

employee-specific billings such as Interrupted Military Service Purchase billings, Delinquent Contributions Employer billings, Elected Official Service Purchase billings, or Overpayment

to Pension billings.

Note: When paying penalties and interest, please note the period end date for that charge. When paying an ERI billing or employee-specific billing, please note the employee’s social

security number.

Type of Charge

Social Security Number

Employer Code

Report Period End Date

Amount

(If Applicable)

$

Penalties/Interest

ERI

Employee Billing

$

Penalties/Interest

ERI

Employee Billing

Penalties/Interest

ERI

Employee Billing

$

Section 5 – Employer Credit

If you have a credit on your employer account, please list the amount of the credit you would like to apply against the above employer contribution or employer liabilities.

Note: You cannot use your credit toward employee retirement contributions or service purchase payroll deductions.

Credit Amount: __________________________

on employer code(s): __________________

Apply Credit to Employer Code: ___________________________________________________

Questions on using this form? Contact us at 1-888-400-0965, or . Streamline this process by paying electronically via ECS (the electronic Employer Contribution System). Ask us how.

(E-3 Revised 12/08)

1

1