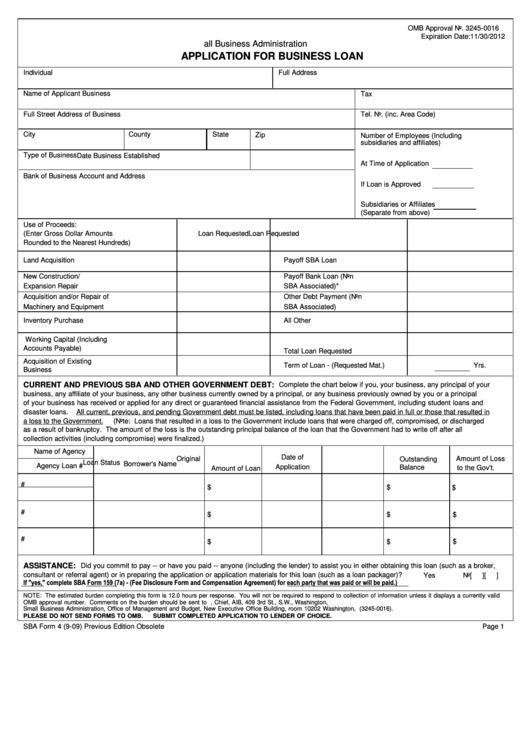

Sba Form 4 - Application For Business Loan

ADVERTISEMENT

OMB Approval No. 3245-0016

Expiration Date:

11/30/2012

U.S. Small Business Administration

APPLICATION FOR BUSINESS LOAN

Individual

Full Address

Name of Applicant Business

Tax I.D. No. or SSN

Full Street Address of Business

Tel. No. (inc. Area Code)

City

County

State

Zip

Number of Employees (Including

subsidiaries and affiliates)

Type of Business

Date Business Established

At Time of Application

Bank of Business Account and Address

If Loan is Approved

Subsidiaries or Affiliates

(Separate from above)

Use of Proceeds:

(Enter Gross Dollar Amounts

Loan Requested

Loan Requested

Rounded to the Nearest Hundreds)

Land Acquisition

Payoff SBA Loan

New Construction/

Payoff Bank Loan (Non

Expansion Repair

SBA Associated)*

Acquisition and/or Repair of

Other Debt Payment (Non

Machinery and Equipment

SBA Associated)

Inventory Purchase

All Other

Working Capital (Including

Accounts Payable)

Total Loan Requested

Acquisition of Existing

Term of Loan - (Requested Mat.)

Yrs.

Business

CURRENT AND PREVIOUS SBA AND OTHER GOVERNMENT DEBT:

Complete the chart below if you, your business, any principal of your

business, any affiliate of your business, any other business currently owned by a principal, or any business previously owned by you or a principal

of your business has received or applied for any direct or guaranteed financial assistance from the Federal Government, including student loans and

disaster loans.

All current, previous, and pending Government debt must be listed, including loans that have been paid in full or those that resulted in

a loss to the Government.

(Note: Loans that resulted in a loss to the Government include loans that were charged off, compromised, or discharged

as a result of bankruptcy. The amount of the loss is the outstanding principal balance of the loan that the Government had to write off after all

collection activities (including compromise) were finalized.)

Name of Agency

Date of

Original

Amount of Loss

Outstanding

Loan Status

Borrower's Name

Agency Loan #

Application

Balance

to the Gov't.

Amount of Loan

#

$

$

$

#

$

$

$

#

$

$

$

ASSISTANCE:

Did you commit to pay -- or have you paid -- anyone (including the lender) to assist you in either obtaining this loan (such as a broker,

consultant or referral agent) or in preparing the application or application materials for this loan (such as a loan packager)?

Yes

[

]

No

[

]

If "yes," complete SBA Form 159 (7a) - (Fee Disclosure Form and Compensation Agreement) for each party that was paid or will be paid.)

NOTE: The estimated burden completing this form is 12.0 hours per response. You will not be required to respond to collection of information unless it displays a currently valid

OMB approval number. Comments on the burden should be sent to U.S. Small Business Administration, Chief, AIB, 409 3rd St., S.W., Washington, D.C. 20416 and Desk Office

Small Business Administration, Office of Management and Budget, New Executive Office Building, room 10202 Washington, D.C. 20503.

OMB Approval (3245-0016).

PLEASE DO NOT SEND FORMS TO OMB.

SUBMIT COMPLETED APPLICATION TO LENDER OF CHOICE.

SBA Form 4 (9-09) Previous Edition Obsolete

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4