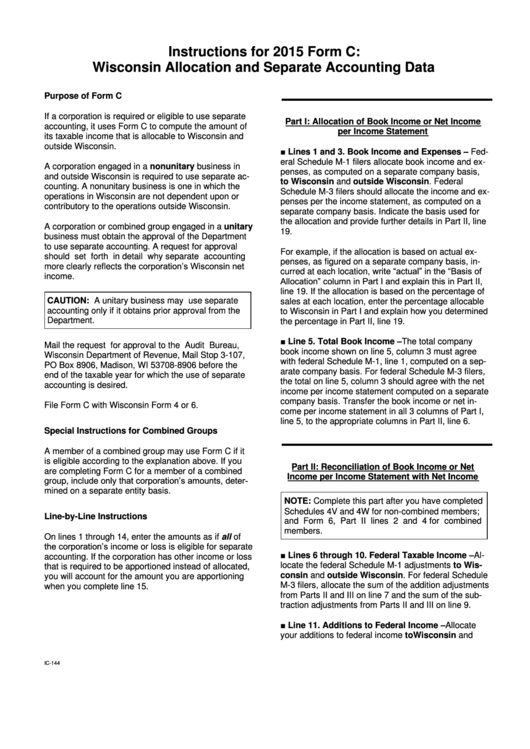

Instructions For 2015 Form C: Wisconsin Allocation And Separate Accounting Data

ADVERTISEMENT

Instructions for 2015 Form C:

Wisconsin Allocation and Separate Accounting Data

Purpose of Form C

If a corporation is required or eligible to use separate

Part I: Allocation of Book Income or Net Income

accounting, it uses Form C to compute the amount of

per Income Statement

its taxable income that is allocable to Wisconsin and

outside Wisconsin.

■ Lines 1 and 3. Book Income and Expenses – Fed-

eral Schedule M-1 filers allocate book income and ex-

A corporation engaged in a nonunitary business in

penses, as computed on a separate company basis,

and outside Wisconsin is required to use separate ac-

to Wisconsin and outside Wisconsin. Federal

counting. A nonunitary business is one in which the

Schedule M-3 filers should allocate the income and ex-

operations in Wisconsin are not dependent upon or

penses per the income statement, as computed on a

contributory to the operations outside Wisconsin.

separate company basis. Indicate the basis used for

the allocation and provide further details in Part II, line

A corporation or combined group engaged in a unitary

19.

business must obtain the approval of the Department

to use separate accounting. A request for approval

For example, if the allocation is based on actual ex-

should set forth in detail why separate accounting

penses, as figured on a separate company basis, in-

more clearly reflects the corporation’s Wisconsin net

curred at each location, write “actual” in the “Basis of

income.

Allocation” column in Part I and explain this in Part II,

line 19. If the allocation is based on the percentage of

CAUTION: A unitary business may use separate

sales at each location, enter the percentage allocable

accounting only if it obtains prior approval from the

to Wisconsin in Part I and explain how you determined

Department.

the percentage in Part II, line 19.

■ Line 5. Total Book Income – The total company

Mail the request for approval to the Audit Bureau,

book income shown on line 5, column 3 must agree

Wisconsin Department of Revenue, Mail Stop 3-107,

with federal Schedule M-1, line 1, computed on a sep-

PO Box 8906, Madison, WI 53708-8906 before the

arate company basis. For federal Schedule M-3 filers,

end of the taxable year for which the use of separate

the total on line 5, column 3 should agree with the net

accounting is desired.

income per income statement computed on a separate

company basis. Transfer the book income or net in-

File Form C with Wisconsin Form 4 or 6.

come per income statement in all 3 columns of Part I,

line 5, to the appropriate columns in Part II, line 6.

Special Instructions for Combined Groups

A member of a combined group may use Form C if it

is eligible according to the explanation above. If you

Part II: Reconciliation of Book Income or Net

are completing Form C for a member of a combined

Income per Income Statement with Net Income

group, include only that corporation’s amounts, deter-

mined on a separate entity basis.

NOTE: Complete this part after you have completed

Schedules 4V and 4W for non-combined members;

Line-by-Line Instructions

and Form 6, Part II lines 2 and 4 for combined

members.

On lines 1 through 14, enter the amounts as if all of

the corporation’s income or loss is eligible for separate

■ Lines 6 through 10. Federal Taxable Income –Al-

accounting. If the corporation has other income or loss

locate the federal Schedule M-1 adjustments to Wis-

that is required to be apportioned instead of allocated,

consin and outside Wisconsin. For federal Schedule

you will account for the amount you are apportioning

M-3 filers, allocate the sum of the addition adjustments

when you complete line 15.

from Parts II and III on line 7 and the sum of the sub-

traction adjustments from Parts II and III on line 9.

■ Line 11. Additions to Federal Income – Allocate

your additions to federal income to Wisconsin and

IC-144

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2