Simple Individual Retirement Account (Ira) Distribution Request Form

ADVERTISEMENT

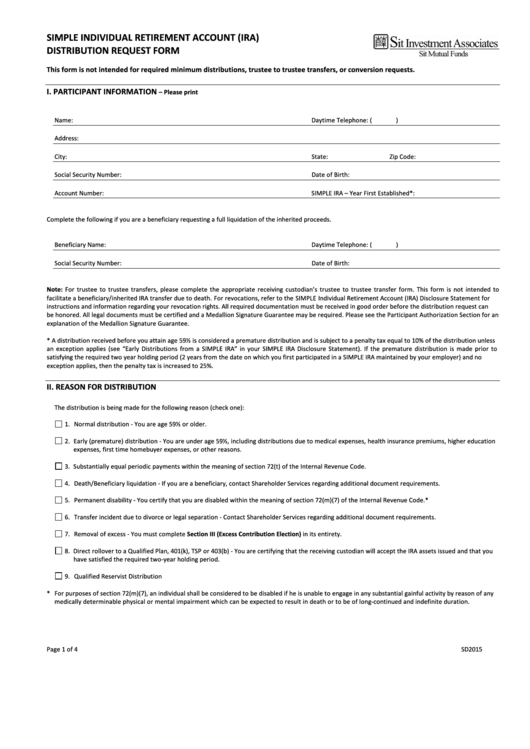

SIMPLE INDIVIDUAL RETIREMENT ACCOUNT (IRA)

DISTRIBUTION REQUEST FORM

This form is not intended for required minimum distributions, trustee to trustee transfers, or conversion requests.

I. PARTICIPANT INFORMATION

– Please print

Name:

Daytime Telephone: (

)

Address:

City:

State:

Zip Code:

Social Security Number:

Date of Birth:

Account Number:

SIMPLE IRA – Year First Established*:

Complete the following if you are a beneficiary requesting a full liquidation of the inherited proceeds.

Beneficiary Name:

Daytime Telephone: (

)

Social Security Number:

Date of Birth:

Note: For trustee to trustee transfers, please complete the appropriate receiving custodian’s trustee to trustee transfer form. This form is not intended to

facilitate a beneficiary/inherited IRA transfer due to death. For revocations, refer to the SIMPLE Individual Retirement Account (IRA) Disclosure Statement for

instructions and information regarding your revocation rights. All required documentation must be received in good order before the distribution request can

be honored. All legal documents must be certified and a Medallion Signature Guarantee may be required. Please see the Participant Authorization Section for an

explanation of the Medallion Signature Guarantee.

* A distribution received before you attain age 59½ is considered a premature distribution and is subject to a penalty tax equal to 10% of the distribution unless

an exception applies (see “Early Distributions from a SIMPLE IRA” in your SIMPLE IRA Disclosure Statement). If the premature distribution is made prior to

satisfying the required two year holding period (2 years from the date on which you first participated in a SIMPLE IRA maintained by your employer) and no

exception applies, then the penalty tax is increased to 25%.

II. REASON FOR DISTRIBUTION

The distribution is being made for the following reason (check one):

1. Normal distribution - You are age 59½ or older.

2. Early (premature) distribution - You are under age 59½, including distributions due to medical expenses, health insurance premiums, higher education

expenses, first time homebuyer expenses, or other reasons.

3. Substantially equal periodic payments within the meaning of section 72(t) of the Internal Revenue Code.

4. Death/Beneficiary liquidation - If you are a beneficiary, contact Shareholder Services regarding additional document requirements.

5. Permanent disability - You certify that you are disabled within the meaning of section 72(m)(7) of the Internal Revenue Code.*

6. Transfer incident due to divorce or legal separation - Contact Shareholder Services regarding additional document requirements.

7. Removal of excess - You must complete Section III (Excess Contribution Election) in its entirety.

8. Direct rollover to a Qualified Plan, 401(k), TSP or 403(b) - You are certifying that the receiving custodian will accept the IRA assets issued and that you

have satisfied the required two-year holding period.

9. Qualified Reservist Distribution

* For purposes of section 72(m)(7), an individual shall be considered to be disabled if he is unable to engage in any substantial gainful activity by reason of any

medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite duration.

Page 1 of 4

SD2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4