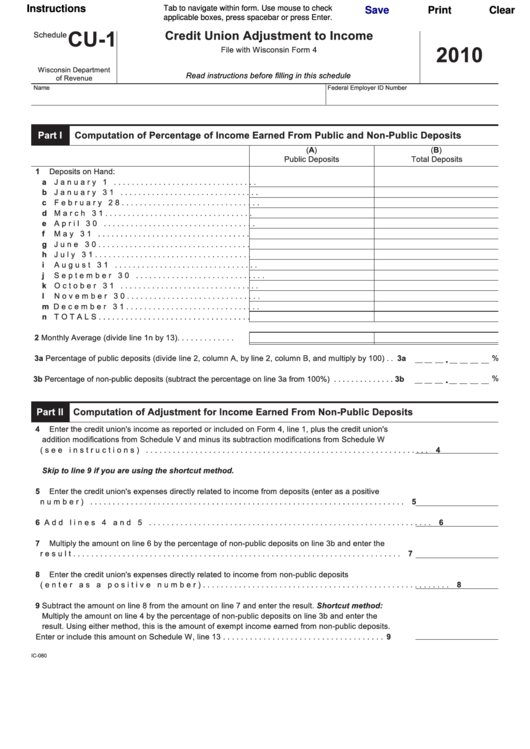

Schedule Cu-1 - Credit Union Adjustment To Income - 2010

ADVERTISEMENT

Instructions

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

CU-1

Credit Union Adjustment to Income

Schedule

2010

File with Wisconsin Form 4

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Name

Federal Employer ID Number

Part I

Computation of Percentage of Income Earned From Public and Non-Public Deposits

(A)

(B)

Public Deposits

Total Deposits

1 Deposits on Hand:

a January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b January 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c February 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d March 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e April 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f May 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

g June 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

h July 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i August 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

j September 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

k October 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

l November 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

m December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

n TOTALS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Monthly Average (divide line 1n by 13) . . . . . . . . . . . . .

.

%

3a Percentage of public deposits (divide line 2, column A, by line 2, column B, and multiply by 100) . . 3a

.

%

3b Percentage of non-public deposits (subtract the percentage on line 3a from 100%) . . . . . . . . . . . . . . 3b

Part II Computation of Adjustment for Income Earned From Non-Public Deposits

4 Enter the credit union's income as reported or included on Form 4, line 1, plus the credit union's

addition modifications from Schedule V and minus its subtraction modifications from Schedule W

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Skip to line 9 if you are using the shortcut method.

5 Enter the credit union's expenses directly related to income from deposits (enter as a positive

number) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Multiply the amount on line 6 by the percentage of non-public deposits on line 3b and enter the

result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Enter the credit union's expenses directly related to income from non-public deposits

(enter as a positive number) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Subtract the amount on line 8 from the amount on line 7 and enter the result . Shortcut method:

Multiply the amount on line 4 by the percentage of non-public deposits on line 3b and enter the

result . Using either method, this is the amount of exempt income earned from non-public deposits .

Enter or include this amount on Schedule W, line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

IC-080

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3