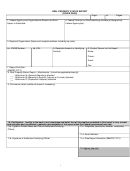

Real Property Status Report (Cover Page) Page 8

ADVERTISEMENT

6. Total share percentage (i.e., sum of share percentages of Federal and non-Federal Share of the Property Cost

must equal 100%).

14h. Has a deed, lien, covenant, or other related documentation been recorded to establish Federal interest in

this real property? If yes, describe the instrument used and enter the date and jurisdiction in which it was

recorded. Check either “yes” or “no” to indicate if the documentation has been recorded. If the awarding agency has

not imposed the requirement to record Federal interest in the real property, check “NA”. If Federal interest has been

recorded, enter the instrument used (i.e., deed, lien, covenant, etc.) along with the date and jurisdiction in which it was

recorded (ex., Executed on 01/04/2007, in the Arlington, VA County Clerk’s office, Deed book #54987, page 234). The

recordation of Federal interest in real property must be reported by not later than the next scheduled reporting date after

the real property has been acquired, improved or donated, or as directed by the awarding agency in the award

document. The recipient must maintain records of the recordation of Federal interest in real property and make such

records available upon the request of the Federal government.

14i. Has Federally Required Insurance Coverage been secured for this real property? Check either “yes” or “no” to

indicate if Federally required insurance has been secured for the real property. The recipient must maintain records of

the insurance coverage that has been secured for the real property and make the records available upon the request of

the Federal government. Note: Recipients must provide insurance coverage for any real property acquired under a

Federal financial assistance award that is, at a minimum, equivalent to insurance coverage that the recipient provides for

other real property they own.

14j. Are there any Uniform Relocation Act requirements applicable to this real property? If the acquisition or

development of the real property involved the movement of any person who moved permanently from real property or

moved personal property from real property directly because of acquisition, rehabilitation, or demolition for an activity

undertaken with Federal assistance, the Uniform Relocation Act requirements may apply. Indicate if the Act applies by

checking “yes or no”.

If the Act does apply, the recipient must maintain records of compliance and make such

information available upon the request of the Federal government.

14k. Are there any environmental compliance requirements related to the real property? If yes, describe them.

Check either “yes” or “no” to indicate if there are any environmental compliance requirements related to the real property.

Describe any environmental compliance requirements related to the real property. The recipient must maintain records

of compliance with all environmental requirements related to the real property and make such information available upon

the request of the Federal government. (Attach additional sheets if necessary).

14l. In accordance with the National Historic Preservation Act (NHPA), does the property possess historic

significance, and/or is listed or eligible for listing in the National Register of Historic Places? In accordance with

the Section 106 of the National Historic Preservation Act (NHPA), does the property possess historic significance,

and/or is listed or eligible for listing in the National Register of Historic Places? Describe any historical significance,

National Register of Historic Places listing or eligibility for such listing, related to the real property. Note, any property

listed in, or eligible for listing in the National Register of Historic Places is considered historic. Section 106 protections

also extend to properties that possess significance but have not yet been listed or formally determined eligible for

listing.

15. Has a significant change occurred with the real property that is not otherwise captured above? Check the

applicable block to indicate either “yes” or “no.” If a significant change has occurred, such as a major building renovation

or remodeling, damage to the real property due to an act of God (flood, hurricane, earthquake, etc.) or other significant

change that would affect the value of the property, describe the change. (Attach additional sheets if necessary) Note: If a

significant change has occurred, 14g. should be recalculated to reflect the change in Federal interest.

16. Real Property Disposition Status. Check the appropriate block (A – E) to indicate the type of disposition status

being reported.

i. If the Federal agency provided the recipient with disposition instructions to sell or retain title

to the real property, enter the amount of funds owed to the Federal government.

Enter the

amount of funds owed to the Federal government as compensation for the Federal interest in the real

property in the event the awarding agency either, directed the recipient to sell or, granted them

permission to retain title to the real property.

viii

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13