Form V-3405-0512 - Hsa Rollover/transfer Form

ADVERTISEMENT

2000 N. Classen Boulevard, 7E

Oklahoma City, OK 73106-6013

2000 N. Classen Boulevard, G16

Phone: 866-326-3600

Oklahoma City, OK 73106-6013

Fax: (405) 523-5072

866-326-3600

Website:

Email:

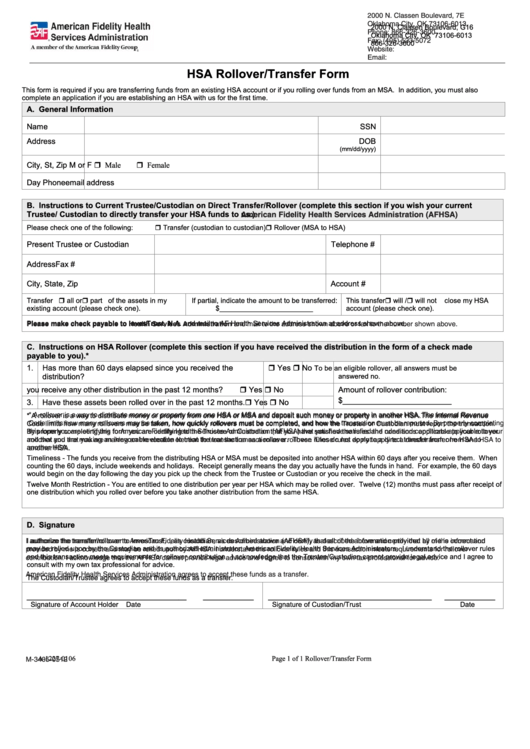

HSA Rollover/Transfer Form

This form is required if you are transferring funds from an existing HSA account or if you rolling over funds from an MSA. In addition, you must also

complete an application if you are establishing an HSA with us for the first time.

A. General Information

Name

SSN

Address

DOB

(mm/dd/yyyy)

City, St, Zip

M or F

Male

Female

Day Phone

email address

B. Instructions to Current Trustee/Custodian on Direct Transfer/Rollover (complete this section if you wish your current

Trustee/ Custodian to directly transfer your HSA funds to us.)

American Fidelity Health Services Administration (AFHSA)

Please check one of the following:

Transfer (custodian to custodian)

Rollover (MSA to HSA)

Present Trustee or Custodian

Telephone #

Address

Fax #

City, State, Zip

Account #

Transfer

all or

part of the assets in my

If partial, indicate the amount to be transferred:

This transfer

will /

will not

close my HSA

existing account (please check one).

$________________________

account (please check one).

Please make check payable to InvesTrust, N.A. and mail to AF Health Services Administration at address shown above.

Please make check payable to Health Services Administration and mail to the address shown above or fax to the number shown above.

C. Instructions on HSA Rollover (complete this section if you have received the distribution in the form of a check made

payable to you).*

1.

Has more than 60 days elapsed since you received the

Yes

No

To be an eligible rollover, all answers must be

distribution?

answered no.

2.

Did you receive any other distribution in the past 12 months?

Yes

No

Amount of rollover contribution:

$_________________________

3.

Have these assets been rolled over in the past 12 months.

Yes

No

* A rollover is a way to distribute money or property from one HSA or MSA and deposit such money or property in another HSA. The Internal Revenue

* A rollover is a way to distribute money or property from one HSA or MSA and deposit such money or property in another HSA. The Internal Revenue

Code limits how many rollovers may be taken, how quickly rollovers must be completed, and how the Trustee or Custodian must report the transaction.

Code limits how many rollovers may be taken, how quickly rollovers must be completed, and how the transaction must be reported. By properly completing

By properly completing this form you are certifying to the Trustee or Custodian that you have satisfied the rules and conditions applicable to your rollover

this form you are certifying to American Fidelity Health Services Administration (AFHSA) that you have satisfied the rules and conditions applicable to your

and that you are making an irrevocable election to treat the transaction as a rollover. These rules do not apply to a direct transfer from one HSA to

rollover and that you are making an irrevocable election to treat the transaction as a rollover. These rules do not apply to a direct transfer from one HSA to

another HSA.

another HSA.

Timeliness - The funds you receive from the distributing HSA or MSA must be deposited into another HSA within 60 days after you receive them. When

counting the 60 days, include weekends and holidays. Receipt generally means the day you actually have the funds in hand. For example, the 60 days

would begin on the day following the day you pick up the check from the Trustee or Custodian or you receive the check in the mail.

Twelve Month Restriction - You are entitled to one distribution per year per HSA which may be rolled over. Twelve (12) months must pass after receipt of

one distribution which you rolled over before you take another distribution from the same HSA.

D. Signature

I authorize the transfer/rollover to InvesTrust, N.A., as custodian, as described above and certify that all of the information provided by me is correct and

I authorize the transfer/rollover to American Fidelity Health Services Administration (AFHSA), as described above and certify that all of the information

may be relied upon by the Custodian and its authorized administrator, American Fidelity Health Services Administrators. I understand the rollover rules

provided by me is correct and may be relied upon by AFHSA. I understand the rollover rules and this transaction meets requirements for rollover

and this transaction meets requirements for rollover contribution. I acknowledge that the Trustee/Custodian cannot provide legal advice and I agree to

contribution. I acknowledge that the AFHSA cannot provide legal advice and I agree to consult with my own tax professional for advice.

consult with my own tax professional for advice.

American Fidelity Health Services Administration agrees to accept these funds as a transfer.

The Custodian/Trustee agrees to accept these funds as a transfer.

_________________________________________

_____________

__________________________________________

_____________

Signature of Account Holder

Date

Signature of Custodian/Trust

Date

A-1227-0106

Page 1 of 1

Rollover/Transfer Form

M-3405-0512

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1