Managing Money & Love Managing Money & Love

ADVERTISEMENT

Managing Money & Love

Managing Money & Love

Budgeting

Budget Basics

Issue 3:

In this issue, you will learn to make a monthly spending plan.

Monthly expenses that stay about the same each month are easy to

Some families seem to have

remember. You will also learn to plan for non-monthly periodic

a knack for making ends meet.

expenses that can be budget-busters if you don’t have money set

The difference is not how much

aside for them.

money they have but how well

Most “unexpected” expenses are things we’ve “neglected” in our

they manage their resources.

spending plan. What are some expenses that always seem to cause

These families have learned the

stress for your family?

value of planning and

controlling expenses by using a

The next sections can help you decide if it’s the little things or

spending plan.

the big things that cause the most trouble. You may get a few ideas

for ways to plan for or to control them.

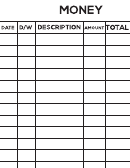

Little Things Add Up

Does your money seem to just disappear?

Cutting out a few daily expenses can

do magic!

Figure how much these “little things” cost each

year. (Answers on page 2)

1. Eating out $5/day = $150/month x 12 or

$_______ year.

2. Soft drink $1/day = $30/month x 12 or

$______ year.

3. Movie rental $5/week x 52 = $______ year.

4. Cigarettes $4/day x 365 = $_____ year.

5. Coffee $2/day x 365 = $_____ year.

6. Snacks $1/day x 365 = $_____ year.

7. Alcohol $20/week x 52 = $_____ year.

All of these together add up to $7,015/year.

DIVISION OF AGRICULTURE

What else could you do with nearly $600/month?

R E S E A R C H & E X T E N S I O N

University of Arkansas System

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4