Managing Money & Love Managing Money & Love Page 2

ADVERTISEMENT

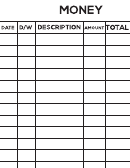

Knowledge About Spending Plans

Use these words to complete the statements and increase your knowledge about spending plans.

debt

fixed

income

periodic

expenses

flexible

needs

written

. A spending plan helps couples to live

1

within their _____________.

2. One of the best ways to stay on track

with a spending plan is to stay out of

_________.

3. Two major parts of a spending plan are

income and _______________.

4. Before developing a spending plan, it is

a good idea to keep a ______________

record of your income and expenses for

two or three months. This helps you

establish a more realistic and accurate

plan you can stick with.

5. Expenses that stay the same each month, like housing, car payments or other monthly installment

credit payments, are called ____________ expenses. These are the easiest payments to remember and

the hardest to change. Write them on your spending plan first.

6. Expenses that change from month to month are called ________________ expenses. These may

include food, clothing, gasoline, personal care and most daily expenses. The envelope method is one

way to control these. Write how much you can afford on your spending plan, and put that amount in

an envelope labeled for that category. When the envelope is empty, it’ s time to stop spending.

7. Irregular or _____________ expenses that don’t occur every month are the hardest to remember. To

avoid budget bumps and bulges, plan for these annual expenses.

8. Separating wants from ________ , or what is absolutely necessary, is another important part of

budgeting. Include necessities in your budget first and make sure to set aside the money to cover

those that are a priority. Some people who fail to plan mistakenly believe they have money to spend

on what they want when they get a paycheck. Those who have planned carefully realize that most of

their income is already designated for other expenses before it arrives.

• 2 •

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4