Managing Money & Love Managing Money & Love Page 3

ADVERTISEMENT

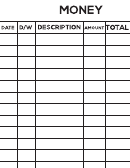

Monthly Spending Plan

GROSS INCOME

$

Minus taxes and other deductions

NET INCOME

$

The

first step

in

making a spending

ESTIMATED EXPENSES

plan is to

figure

your income

and

Housing

estimate your

expenses. If you

Food at home

keep a written record

of what you actually

Food away from home

spend for a month or

two, your estimated

Clothing

expenses will be

more realistic.

Clothing care

Life insurance*

Car payment(s)

Use the form to the

left to record income

Gasoline

and expenses.

Finally, subtract your

Utilities (gas, water, electricity)

total expenses from

your net income. If

Cable TV

the result is negative,

look for ways to cut

Telephone

back.Your goal is

to

balance

your

Home furnishings/appliances

income with your

expenses.

Credit card payments

Other loans

Personal care

Health care (doctor, dentist, medicine)

Household supplies

Recreation

Emergency fund/savings

Savings for non-monthly expenses (see next page)

Miscellaneous (pets, hobbies, club dues, subscriptions)

TOTAL EXPENSES

$

DIFFERENCE BETWEEN INCOME AND EXPENSES

$

*Do not include if payroll deducted.

For an EXCEL spreadsheet template to design your spending plan, visit our web site at

• 3 •

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4