Sprint Foundation Matching Gift Program

ADVERTISEMENT

Established in Honor of Paul H. Henson

M

A

T

C

H

I

N

G

G

I

F

T

M

A

T

C

H

I

N

G

G

I

F

T

P R O G R A M

T

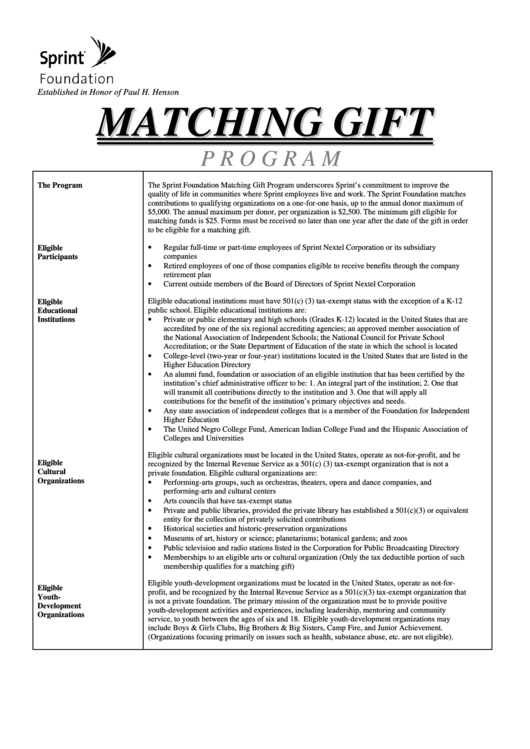

The Program

The Sprint Foundation Matching Gift Program underscores Sprint’s commitment to improve the

quality of life in communities where Sprint employees live and work. The Sprint Foundation matches

contributions to qualifying organizations on a one-for-one basis, up to the annual donor maximum of

$5,000. The annual maximum per donor, per organization is $2,500. The minimum gift eligible for

matching funds is $25. Forms must be received no later than one year after the date of the gift in order

to be eligible for a matching gift.

•

Eligible

Regular full-time or part-time employees of Sprint Nextel Corporation or its subsidiary

companies

Participants

•

Retired employees of one of those companies eligible to receive benefits through the company

retirement plan

•

Current outside members of the Board of Directors of Sprint Nextel Corporation

Eligible

Eligible educational institutions must have 501(c) (3) tax-exempt status with the exception of a K-12

Educational

public school. Eligible educational institutions are:

•

Institutions

Private or public elementary and high schools (Grades K-12) located in the United States that are

accredited by one of the six regional accrediting agencies; an approved member association of

the National Association of Independent Schools; the National Council for Private School

Accreditation; or the State Department of Education of the state in which the school is located

•

College-level (two-year or four-year) institutions located in the United States that are listed in the

Higher Education Directory

•

An alumni fund, foundation or association of an eligible institution that has been certified by the

institution’s chief administrative officer to be: 1. An integral part of the institution; 2. One that

will transmit all contributions directly to the institution and 3. One that will apply all

contributions for the benefit of the institution’s primary objectives and needs.

•

Any state association of independent colleges that is a member of the Foundation for Independent

Higher Education

•

The United Negro College Fund, American Indian College Fund and the Hispanic Association of

Colleges and Universities

Eligible cultural organizations must be located in the United States, operate as not-for-profit, and be

Eligible

recognized by the Internal Revenue Service as a 501(c) (3) tax-exempt organization that is not a

Cultural

private foundation. Eligible cultural organizations are:

Organizations

•

Performing-arts groups, such as orchestras, theaters, opera and dance companies, and

performing-arts and cultural centers

•

Arts councils that have tax-exempt status

•

Private and public libraries, provided the private library has established a 501(c)(3) or equivalent

entity for the collection of privately solicited contributions

•

Historical societies and historic-preservation organizations

•

Museums of art, history or science; planetariums; botanical gardens; and zoos

•

Public television and radio stations listed in the Corporation for Public Broadcasting Directory

•

Memberships to an eligible arts or cultural organization (Only the tax deductible portion of such

membership qualifies for a matching gift)

Eligible youth-development organizations must be located in the United States, operate as not-for-

Eligible

profit, and be recognized by the Internal Revenue Service as a 501(c)(3) tax-exempt organization that

Youth-

is not a private foundation. The primary mission of the organization must be to provide positive

Development

youth-development activities and experiences, including leadership, mentoring and community

Organizations

service, to youth between the ages of six and 18. Eligible youth-development organizations may

include Boys & Girls Clubs, Big Brothers & Big Sisters, Camp Fire, and Junior Achievement.

(Organizations focusing primarily on issues such as health, substance abuse, etc. are not eligible).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3