Instructions For Form 706 - 2016

ADVERTISEMENT

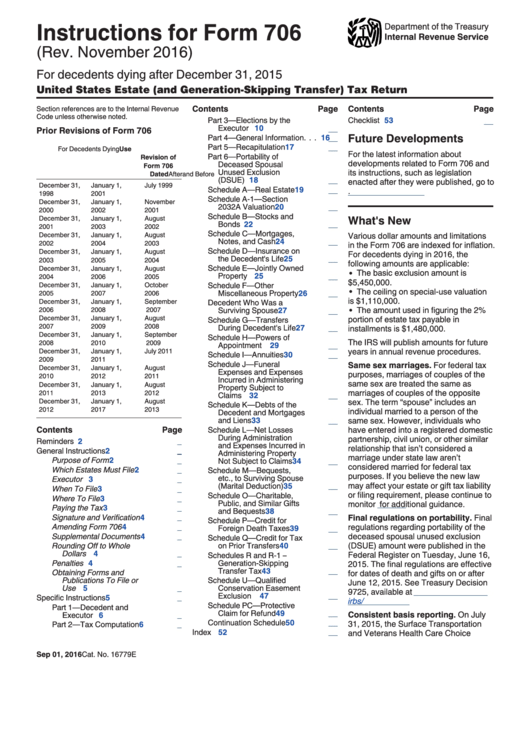

Instructions for Form 706

Department of the Treasury

Internal Revenue Service

(Rev. November 2016)

For decedents dying after December 31, 2015

United States Estate (and Generation-Skipping Transfer) Tax Return

Contents

Page

Contents

Page

Section references are to the Internal Revenue

Code unless otherwise noted.

Part 3—Elections by the

Checklist . . . . . . . . . . . . . . . . . . .

53

Executor . . . . . . . . . . . . . .

10

Prior Revisions of Form 706

Future Developments

Part 4—General Information . . .

16

Part 5—Recapitulation . . . . . . .

17

For Decedents Dying

Use

For the latest information about

Part 6—Portability of

Revision of

developments related to Form 706 and

Deceased Spousal

Form 706

Unused Exclusion

its instructions, such as legislation

After

and Before

Dated

(DSUE) . . . . . . . . . . . . . . .

18

enacted after they were published, go to

December 31,

January 1,

July 1999

Schedule A—Real Estate . . . . .

19

1998

2001

Schedule A-1—Section

December 31,

January 1,

November

2032A Valuation . . . . . . . . .

20

2000

2002

2001

Schedule B—Stocks and

What's New

December 31,

January 1,

August

Bonds . . . . . . . . . . . . . . . .

22

2001

2003

2002

Schedule C—Mortgages,

December 31,

January 1,

August

Various dollar amounts and limitations

Notes, and Cash . . . . . . . . .

24

2002

2004

2003

in the Form 706 are indexed for inflation.

Schedule D—Insurance on

December 31,

January 1,

August

For decedents dying in 2016, the

the Decedent's Life . . . . . . .

25

2003

2005

2004

following amounts are applicable:

Schedule E—Jointly Owned

December 31,

January 1,

August

The basic exclusion amount is

Property . . . . . . . . . . . . . .

25

2004

2006

2005

$5,450,000.

December 31,

January 1,

October

Schedule F—Other

The ceiling on special-use valuation

Miscellaneous Property . . . .

26

2005

2007

2006

is $1,110,000.

December 31,

January 1,

September

Decedent Who Was a

The amount used in figuring the 2%

2006

2008

2007

Surviving Spouse . . . . . . . .

27

December 31,

January 1,

August

portion of estate tax payable in

Schedule G—Transfers

2007

2009

2008

During Decedent's Life . . . . .

27

installments is $1,480,000.

December 31,

January 1,

September

Schedule H—Powers of

The IRS will publish amounts for future

2008

2010

2009

Appointment . . . . . . . . . . .

29

years in annual revenue procedures.

December 31,

January 1,

July 2011

Schedule I—Annuities . . . . . . .

30

2009

2011

Schedule J—Funeral

Same sex marriages. For federal tax

December 31,

January 1,

August

Expenses and Expenses

purposes, marriages of couples of the

2010

2012

2011

Incurred in Administering

same sex are treated the same as

December 31,

January 1,

August

Property Subject to

marriages of couples of the opposite

2011

2013

2012

Claims . . . . . . . . . . . . . . .

32

December 31,

January 1,

August

sex. The term “spouse” includes an

Schedule K—Debts of the

2012

2017

2013

individual married to a person of the

Decedent and Mortgages

and Liens . . . . . . . . . . . . .

33

same sex. However, individuals who

Contents

Page

have entered into a registered domestic

Schedule L—Net Losses

During Administration

partnership, civil union, or other similar

Reminders . . . . . . . . . . . . . . . . . . .

2

and Expenses Incurred in

relationship that isn’t considered a

General Instructions . . . . . . . . . . . . .

2

Administering Property

marriage under state law aren’t

Purpose of Form . . . . . . . . . . . .

2

Not Subject to Claims . . . . . .

34

considered married for federal tax

Which Estates Must File . . . . . . .

2

Schedule M—Bequests,

purposes. If you believe the new law

etc., to Surviving Spouse

Executor . . . . . . . . . . . . . . . . .

3

may affect your estate or gift tax liability

(Marital Deduction) . . . . . . .

35

When To File . . . . . . . . . . . . . .

3

or filing requirement, please continue to

Schedule O—Charitable,

Where To File . . . . . . . . . . . . . .

3

Public, and Similar Gifts

monitor

IRS.gov

for additional guidance.

Paying the Tax . . . . . . . . . . . . .

3

and Bequests . . . . . . . . . . .

38

Signature and Verification . . . . . .

4

Final regulations on portability. Final

Schedule P—Credit for

regulations regarding portability of the

Amending Form 706 . . . . . . . . .

4

Foreign Death Taxes . . . . . .

39

deceased spousal unused exclusion

Supplemental Documents . . . . . .

4

Schedule Q—Credit for Tax

(DSUE) amount were published in the

Rounding Off to Whole

on Prior Transfers . . . . . . . .

40

Dollars . . . . . . . . . . . . . . . .

4

Federal Register on Tuesday, June 16,

Schedules R and R-1 –

Penalties . . . . . . . . . . . . . . . . .

4

Generation-Skipping

2015. The final regulations are effective

Transfer Tax

. . . . . . . . . . .

43

Obtaining Forms and

for dates of death and gifts on or after

Publications To File or

Schedule U—Qualified

June 12, 2015. See Treasury Decision

Use . . . . . . . . . . . . . . . . . .

5

Conservation Easement

9725, available at

Exclusion

. . . . . . . . . . . . .

47

Specific Instructions . . . . . . . . . . . . .

5

irbs/irb15-26.pdf.

Schedule PC—Protective

Part 1—Decedent and

Claim for Refund . . . . . . . . .

49

Consistent basis reporting. On July

Executor . . . . . . . . . . . . . . .

6

Continuation Schedule . . . . . . .

50

31, 2015, the Surface Transportation

Part 2—Tax Computation . . . . . .

6

Index . . . . . . . . . . . . . . . . . . . . .

52

and Veterans Health Care Choice

Sep 01, 2016

Cat. No. 16779E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54