Customs Power Of Attorney/designation As Export Forwarding Agent Form And Acknowledgement Of Terms And Conditions

ADVERTISEMENT

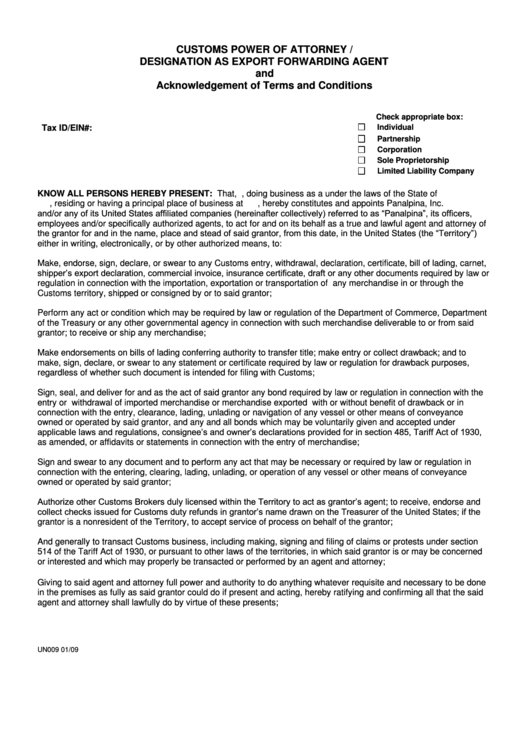

CUSTOMS POWER OF ATTORNEY /

DESIGNATION AS EXPORT FORWARDING AGENT

and

Acknowledgement of Terms and Conditions

Check appropriate box:

Individual

Tax ID/EIN#:

Partnership

Corporation

Sole Proprietorship

Limited Liability Company

KNOW ALL PERSONS HEREBY PRESENT: That,

, doing business as a

under the laws of the State of

, residing or having a principal place of business at

, hereby constitutes and appoints Panalpina, Inc.

and/or any of its United States affiliated companies (hereinafter collectively) referred to as “Panalpina”, its officers,

employees and/or specifically authorized agents, to act for and on its behalf as a true and lawful agent and attorney of

the grantor for and in the name, place and stead of said grantor, from this date, in the United States (the “Territory”)

either in writing, electronically, or by other authorized means, to:

Make, endorse, sign, declare, or swear to any Customs entry, withdrawal, declaration, certificate, bill of lading, carnet,

shipper’s export declaration, commercial invoice, insurance certificate, draft or any other documents required by law or

regulation in connection with the importation, exportation or transportation of any merchandise in or through the

Customs territory, shipped or consigned by or to said grantor;

Perform any act or condition which may be required by law or regulation of the Department of Commerce, Department

of the Treasury or any other governmental agency in connection with such merchandise deliverable to or from said

grantor; to receive or ship any merchandise;

Make endorsements on bills of lading conferring authority to transfer title; make entry or collect drawback; and to

make, sign, declare, or swear to any statement or certificate required by law or regulation for drawback purposes,

regardless of whether such document is intended for filing with Customs;

Sign, seal, and deliver for and as the act of said grantor any bond required by law or regulation in connection with the

entry or withdrawal of imported merchandise or merchandise exported with or without benefit of drawback or in

connection with the entry, clearance, lading, unlading or navigation of any vessel or other means of conveyance

owned or operated by said grantor, and any and all bonds which may be voluntarily given and accepted under

applicable laws and regulations, consignee’s and owner’s declarations provided for in section 485, Tariff Act of 1930,

as amended, or affidavits or statements in connection with the entry of merchandise;

Sign and swear to any document and to perform any act that may be necessary or required by law or regulation in

connection with the entering, clearing, lading, unlading, or operation of any vessel or other means of conveyance

owned or operated by said grantor;

Authorize other Customs Brokers duly licensed within the Territory to act as grantor’s agent; to receive, endorse and

collect checks issued for Customs duty refunds in grantor’s name drawn on the Treasurer of the United States; if the

grantor is a nonresident of the Territory, to accept service of process on behalf of the grantor;

And generally to transact Customs business, including making, signing and filing of claims or protests under section

514 of the Tariff Act of 1930, or pursuant to other laws of the territories, in which said grantor is or may be concerned

or interested and which may properly be transacted or performed by an agent and attorney;

Giving to said agent and attorney full power and authority to do anything whatever requisite and necessary to be done

in the premises as fully as said grantor could do if present and acting, hereby ratifying and confirming all that the said

agent and attorney shall lawfully do by virtue of these presents;

UN009 01/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6