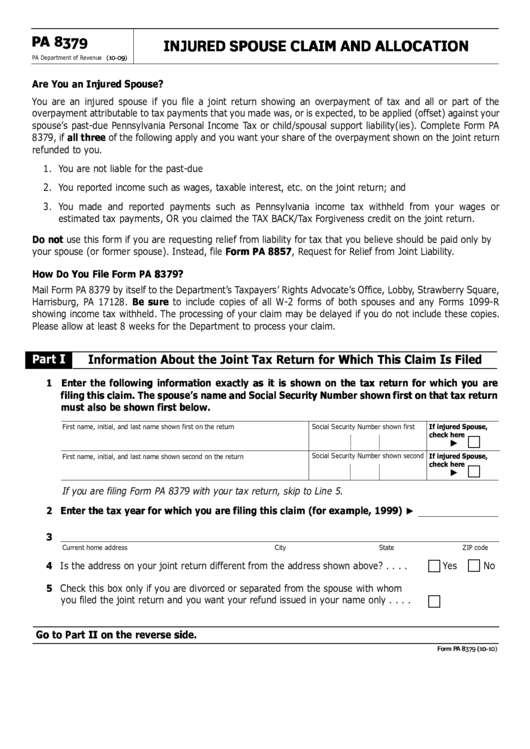

Pa 8379 - Injured Spouse Claim And Allocation

ADVERTISEMENT

PA 8379

INJURED SPOUSE CLAIM AND ALLOCATION

PA Department of Revenue (10-09)

Are You an Injured Spouse?

You are an injured spouse if you file a joint return showing an overpayment of tax and all or part of the

overpayment attributable to tax payments that you made was, or is expected, to be applied (offset) against your

spouse’s past-due Pennsylvania Personal Income Tax or child/spousal support liability(ies). Complete Form PA

8379, if all three of the following apply and you want your share of the overpayment shown on the joint return

refunded to you.

1. You are not liable for the past-due

2. You reported income such as wages, taxable interest, etc. on the joint return; and

3. You made and reported payments such as Pennsylvania income tax withheld from your wages or

estimated tax payments, OR you claimed the TAX BACK/Tax Forgiveness credit on the joint return.

Do not use this form if you are requesting relief from liability for tax that you believe should be paid only by

your spouse (or former spouse). Instead, file Form PA 8857, Request for Relief from Joint Liability.

How Do You File Form PA 8379?

Mail Form PA 8379 by itself to the Department’s Taxpayers’ Rights Advocate’s Office, Lobby, Strawberry Square,

Harrisburg, PA 17128. Be sure to include copies of all W-2 forms of both spouses and any Forms 1099-R

showing income tax withheld. The processing of your claim may be delayed if you do not include these copies.

Please allow at least 8 weeks for the Department to process your claim.

Part I

Information About the Joint Tax Return for Which This Claim Is Filed

1 Enter the following information exactly as it is shown on the tax return for which you are

filing this claim. The spouse’s name and Social Security Number shown first on that tax return

must also be shown first below.

First name, initial, and last name shown first on the return

Social Security Number shown first

If injured Spouse,

check here

Social Security Number shown second

If injured Spouse,

First name, initial, and last name shown second on the return

check here

If you are filing Form PA 8379 with your tax return, skip to Line 5.

2 Enter the tax year for which you are filing this claim (for example, 1999)

3

Current home address

City

State

ZIP code

4 Is the address on your joint return different from the address shown above? . . . .

Yes

No

5 Check this box only if you are divorced or separated from the spouse with whom

you filed the joint return and you want your refund issued in your name only . . . .

Go to Part II on the reverse side.

Form PA 8379 (10-10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2