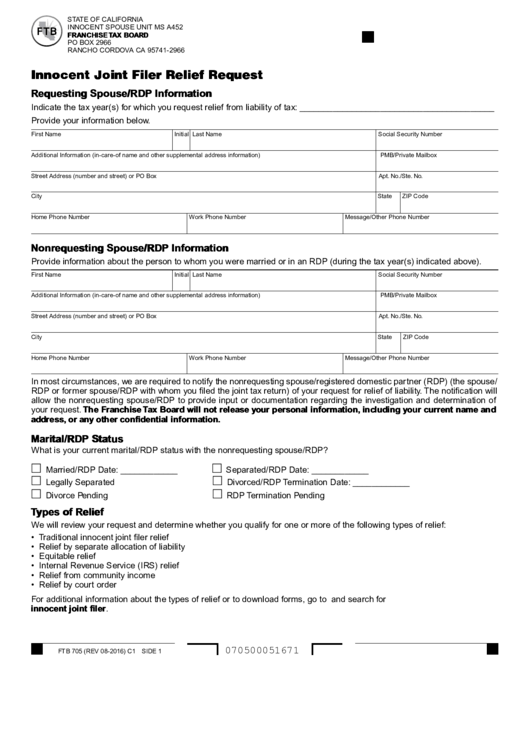

STATE OF CALIFORNIA

INNOCENT SPOUSE UNIT MS A452

FRANCHISE TAX BOARD

PO BOX 2966

RANCHO CORDOVA CA 95741-2966

Innocent Joint Filer Relief Request

Requesting Spouse/RDP Information

Indicate the tax year(s) for which you request relief from liability of tax: _________________________________________

Provide your information below.

First Name

Initial Last Name

Social Security Number

Additional Information (in-care-of name and other supplemental address information)

PMB/Private Mailbox

Street Address (number and street) or PO Box

Apt. No./Ste. No.

City

State

ZIP Code

Home Phone Number

Work Phone Number

Message/Other Phone Number

Nonrequesting Spouse/RDP Information

Provide information about the person to whom you were married or in an RDP (during the tax year(s) indicated above).

First Name

Initial Last Name

Social Security Number

Additional Information (in-care-of name and other supplemental address information)

PMB/Private Mailbox

Street Address (number and street) or PO Box

Apt. No./Ste. No.

City

State

ZIP Code

Home Phone Number

Work Phone Number

Message/Other Phone Number

In most circumstances, we are required to notify the nonrequesting spouse/registered domestic partner (RDP) (the spouse/

RDP or former spouse/RDP with whom you filed the joint tax return) of your request for relief of liability. The notification will

allow the nonrequesting spouse/RDP to provide input or documentation regarding the investigation and determination of

your request. The Franchise Tax Board will not release your personal information, including your current name and

address, or any other confidential information.

Marital/RDP Status

What is your current marital/RDP status with the nonrequesting spouse/RDP?

Married/RDP Date: ____________

Separated/RDP Date: ____________

Legally Separated

Divorced/RDP Termination Date: ____________

Divorce Pending

RDP Termination Pending

Types of Relief

We will review your request and determine whether you qualify for one or more of the following types of relief:

• Traditional innocent joint filer relief

• Relief by separate allocation of liability

• Equitable relief

• Internal Revenue Service (IRS) relief

• Relief from community income

• Relief by court order

For additional information about the types of relief or to download forms, go to ftb.ca.gov and search for

innocent joint filer.

070500051671

FTB 705 (REV 08-2016) C1 SIDE 1

1

1 2

2