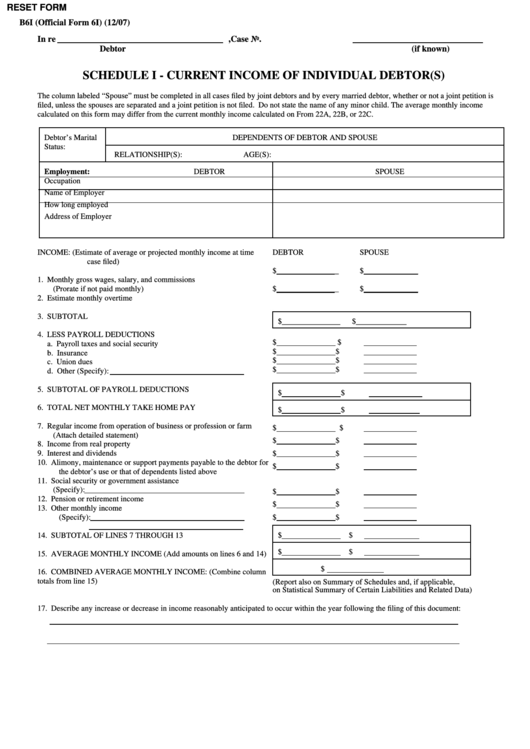

RESET FORM

B6I (Official Form 6I) (12/07)

In re

,

Case No.

Debtor

(if known)

SCHEDULE I - CURRENT INCOME OF INDIVIDUAL DEBTOR(S)

The column labeled “Spouse” must be completed in all cases filed by joint debtors and by every married debtor, whether or not a joint petition is

filed, unless the spouses are separated and a joint petition is not filed. Do not state the name of any minor child. The average monthly income

calculated on this form may differ from the current monthly income calculated on From 22A, 22B, or 22C.

Debtor’s Marital

DEPENDENTS OF DEBTOR AND SPOUSE

Status:

RELATIONSHIP(S):

AGE(S):

Employment:

DEBTOR

SPOUSE

Occupation

Name of Employer

How long employed

Address of Employer

INCOME: (Estimate of average or projected monthly income at time

DEBTOR

SPOUSE

case filed)

$________________

$______________

1. Monthly gross wages, salary, and commissions

(Prorate if not paid monthly)

$________________

$______________

2. Estimate monthly overtime

3. SUBTOTAL

$_______________

$_____________

4. LESS PAYROLL DEDUCTIONS

$

$

a. Payroll taxes and social security

$

$

b. Insurance

$

$

c. Union dues

$

$

d. Other (Specify):

5. SUBTOTAL OF PAYROLL DEDUCTIONS

$

$

6. TOTAL NET MONTHLY TAKE HOME PAY

$

$

7. Regular income from operation of business or profession or farm

$

$

(Attach detailed statement)

$

$

8. Income from real property

9. Interest and dividends

$

$

10. Alimony, maintenance or support payments payable to the debtor for

$

$

the debtor’s use or that of dependents listed above

11. Social security or government assistance

(Specify):

$

$

12. Pension or retirement income

$

$

13. Other monthly income

(Specify):

$

$

$

$

14. SUBTOTAL OF LINES 7 THROUGH 13

$

$

15. AVERAGE MONTHLY INCOME (Add amounts on lines 6 and 14)

$

16. COMBINED AVERAGE MONTHLY INCOME: (Combine column

totals from line 15)

(Report also on Summary of Schedules and, if applicable,

on Statistical Summary of Certain Liabilities and Related Data)

17. Describe any increase or decrease in income reasonably anticipated to occur within the year following the filing of this document:

1

1